China Releases Tax Policies for Nationwide VAT Pilot Reform Adoption

May 31 – On May 24, China’s Ministry of Finance (MOF) and State Administration of Taxation (SAT) jointly released the “Notice Concerning the Nationwide Adoption of Value-Added Tax (VAT) in lieu of Business Tax (BT) Pilot Tax Collection Policy in the Transportation Industry and Certain Modern Service Industries (Caishui [2013] No. 37, hereinafter referred to as ‘Circular 37’)” to guide the implementation of the nationwide VAT pilot reform that will commence on August 1, 2013.

China’s VAT pilot reform was first implemented in Shanghai at the start of 2012, before then expanding to Beijing in September 2012 and Jiangsu, Anhui, Fujian, Guangdong, Tianjin, Zhejiang, and Hubei later in the same year. Before the initiation of the pilot reform, VAT was levied on the sales and importation of tangible goods, and on the provision of processing, repair and replacement services; whereas BT was levied on the provision of other services and the transfer of intangibles and real property. This taxing mechanism resulted in double taxation and other tax inefficiencies and unfairness.

Therefore, the objective of the pilot reform is to improve the efficiency of China’s national tax system, perfect the VAT deduction chain, and reduce tax burdens for taxpayers. The pilot reform has saved participating taxpayers more than RMB40 billion as of February 2013, according to statistics released by China’s MOF and SAT.

Circular 37 contains a series of measures and regulations stipulating the policies that have been proven to be feasible and effective during the preceding pilot period and will continue to be implemented nationwide as the legal framework for the nationwide VAT pilot reform. These measures and regulations are:

- “Measures for Implementing the Pilot Collection of VAT in lieu of BT”

- “Regulation on Issues Concerning the Pilot Collection of VAT in lieu of BT”

- “Regulation on Transitional Policies Concerning the Pilot Collection of VAT in lieu of BT”

- “Regulation on Taxable Services Adopting Zero-Rated VAT and Tax Exemption Policies”

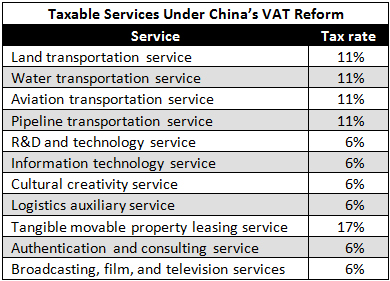

The taxable services covered in the VAT reform and the corresponding tax rates, which will be applied nationwide starting from August 1, are shown below:

Circular 37 also abolished seven previously issued regulations that applied to the preceding pilot period, but will be invalidated from August 1, 2013.

- Notice on Launching the Pilot Collection of VAT in lieu of BT in the Transportation and Certain Modern Service Industries in Shanghai (Caishui [2011] No.111)

- Notice on Taxable Services Adopting Zero-Rated VAT and Tax Exemption Policies (Caishui [2011] No. 131)

- Notice on Several Tax Policies Concerning the Pilot Collection of VAT in lieu of BT in the Transportation and Certain Modern Service Industries (Caishui [2011] No. 133)

- Supplementary Notice on Several Tax Policies Concerning the Pilot Collection of VAT in lieu of BT in the Transportation and Certain Modern Service Industries (Caishui [2012] No. 53)

- Notice on Launching the Pilot Collection of VAT in lieu of BT in the Transportation and Certain Modern Service Industries in Beijing and Other Seven Provinces or Cities (Caishui [2012] No. 71)

- Supplementary Notice Concerning the Scope of Taxable Services Included in Pilot Collection of VAT in lieu of BT in the Transportation and Certain Modern Service Industries (Caishui [2012] No. 86)

- 16th and 18th Provision of Article 3, Notice on Several Policies Concerning BT (Caishui [2003] No. 16)

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Value-Added Tax Reform

Value-Added Tax Reform

VAT reform is a confusing transition for many and introduces a number of additional questions, such as exactly what types of input VAT are now deductible. Confusion about the new laws may also allow opportunistic companies to charge higher prices and blame the increase on the tax reform. To add some clarity to the issue – and VAT in general – this issue of China Briefing takes a look at a number of VAT-related questions.

China to Expand VAT Reform Nationwide Starting August 1, 2013

MOF, SAT Interview on China Tax Reforms

China Issues Announcement on Value-added Tax Declaration

China’s VAT Reform Saves Taxpayers RMB40 Billion

Guangzhou Issues FAQs Regarding VAT Reform

Guangzhou Releases Plan for VAT Pilot Collection

Beijing Issued Announcement on VAT Preferential Policy Administration

China Releases Announcement on VAT Collection in Beijing and Other Regions

- Previous Article Hong Kong and Qatar Sign Comprehensive DTA

- Next Article Control Deals and M&A Opportunities in China Private Equity