Hong Kong Amends Mandatory Contribution Levels for MPF

Jun. 19 – Hong Kong has recently passed legislation that will amend the maximum level of relevant income for compulsory Mandatory Provident Fund (MPF) contributions, effective from June 1, 2012, according to an announcement on the MPF Authority’s official website.

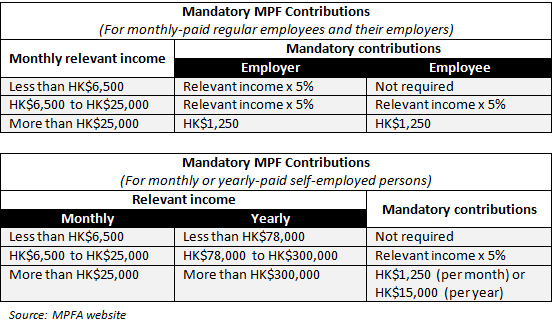

Specifics related to these new MPF guidelines are as follows:

- For monthly-paid regular employees: The maximum level of relevant income has been amended from HK$20,000 per month to HK$25,000 per month. Therefore, maximum mandatory contributions will be adjusted from HK$1,000 per month to HK$1,250 per month.

- For self-employed persons: The maximum level of relevant income has been amended from HK$20,000 per month to HK$25,000 per month and from HK$240,000 per year to HK$300,000 per year. Therefore, maximum mandatory contributions will be adjusted from HK$1,000 per month to HK$1,250 per month or from HK$12,000 per year to HK$15,000 per year.

Note that, according to the MPFA, “relevant income” refers to any wage, salary, leave pay, fee, commission, bonus, gratuity, perquisite or allowance (including housing allowance and other housing benefits), expressed in monetary terms, paid by an employer to an employee. It does not include any severance or long service payments under the Employment Ordinance.

For the contribution periods starting on or after June 1, 2012, employers, employees and self-employed persons should make appropriate adjustments to the mandatory contributions according to the new maximum level of relevant income. These are summarized in the tables below:

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to The China Advantage, our complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Hong Kong and Singapore Holding Companies

Hong Kong and Singapore Holding Companies

In this issue of China Briefing Magazine, we take a closer look at the benefits of both Hong Kong and Singapore holding companies, how to establish and maintain a company in each of these jurisdictions, and the relevant double tax agreements.

Hong Kong City Guide

Hong Kong City Guide

Asia Briefing’s complimentary Hong Kong City Guide is designed for the investor seeking a general overview of one of the world’s most dynamic regions and a key pillar in today’s global economy. Hong Kong has been a major beneficiary of China’s changing economic policy over the past few decades and local authorities have big plans for infrastructure investments and development zones to make the city’s economy even stronger.

The Greater Pearl River Delta: Business Guide to South China (Fourth Edition)

The Greater Pearl River Delta: Business Guide to South China (Fourth Edition)

In this newly-released edition of our regional business guide to South China, we offer business-minded individuals an up-to-date reference source for all of the key issues concerning setting up and successfully operating a business in South China.

- Previous Article China Branch Offices and RO-WFOE ‘Conversions’

- Next Article VAT Reform Rates by Service Type