Average Wages and Social Security Caps for Cities across China

Mar. 27 – Social security in China is a complex topic because although it is based upon guidelines issued by the central government, the specifics and administration of the system is managed at the local level. This is the only practical method in a country as diverse as China, as any rigid system defining specific contributions to be made and benefits receivable could not be expected to meet the needs of citizens in cities as diverse as Shanghai, Harbin, Chengdu and Hohhot, for example.

Monthly contributions to the social security system include pension, health insurance, maternity insurance, work-related injury insurance, unemployment insurance, however the exact employer and employee contribution rates can vary greatly depending on location. We explain each of these categories in detail here.

Calculations are determined from a base figure which, in most cities, is calculated as follows:

- Social security base = Previous year’s total income ÷ 12

For new hires in many cities, the starting salary may be used as the social security base during the first year.

However, it is critical to note that the base figure for social security contributions is capped at 300 percent of the social average salary for the location in which the employee pays social security. Therefore, any employees earning more than this amount will actually pay a smaller percentage of their salary in social security contributions (employers will also have a smaller percentage burden).

The maximum base figures will generally be updated once per year for all employees. This often happens in May, and sometimes the government will also adjust the percentages to be contributed by employees and employers at this time.

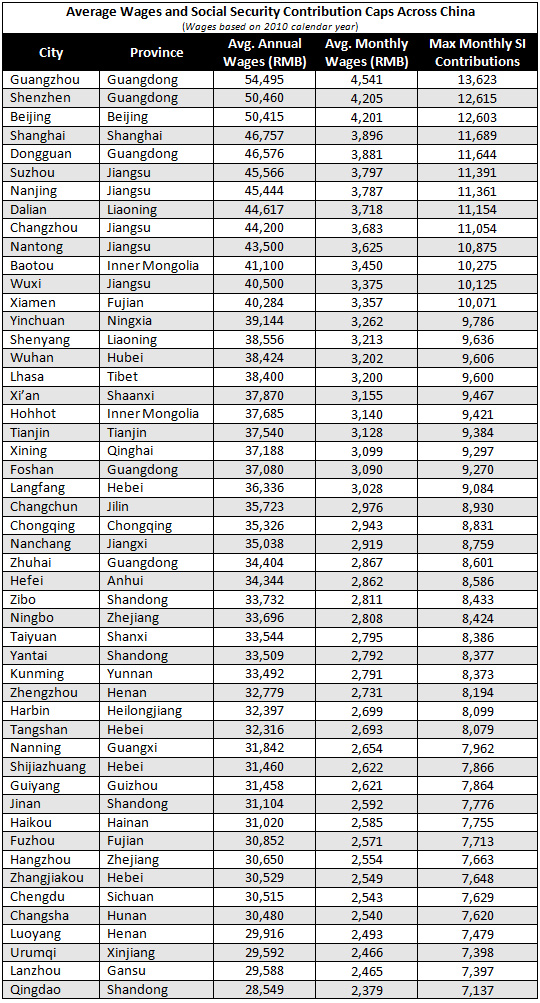

The current average wage levels and maximum monthly social insurance contributions across China’s key cities can be found below. These were released in 2011 and are based on wage levels from the 2010 calender year. When these figures are updated based on the 2011 calendar year (possibly in May 2012), we will create an updated chart and post a link to the new article here.

Dezan Shira & Associates is a specialist foreign direct investment practice and can advise international companies investing in China on the country’s complete legal, tax and operational issues. The firm was established in 1992 and maintains 12 offices throughout China, in addition to practicing in Hong Kong, India, Vietnam and Singapore. The firm can advise on all matters of China HR, payroll and costs. Please contact the firm at china@dezshira.com or visit our web site at www.dezshira.com.

Related Reading

China’s Social Insurance Law

China’s Social Insurance Law

A summary of some of the key points in the newly implemented Social Insurance Law, which covers a great deal more than just incorporating foreigners into the system. We explain the costs and benefits of participation by foreign employees to both companies and individuals as well as take a look at some of the trends across the country relating to the implementation of the law.

Human Resources in China

Human Resources in China

Specifically designed to cover the most important issues relating to managing a Chinese workforce, this guide details the HR issues that both local managers in China and investors looking to establish a presence on the mainland should be aware about.

Mandatory Social Welfare Benefits for Chinese Employees

Calculating Overtime Payments in China

Suzhou Details Foreigners’ Mandatory Social Insurance Participation

- Previous Article Why China’s Consumer Development is Assured

- Next Article American Companies Selling to China – Why and How