Annual Compliance Procedures for China Representative Offices

Feb. 13 – Prior to distributing and repatriating profits, foreign-invested enterprises (FIEs) must complete the annual compliance process.

Feb. 13 – Prior to distributing and repatriating profits, foreign-invested enterprises (FIEs) must complete the annual compliance process.

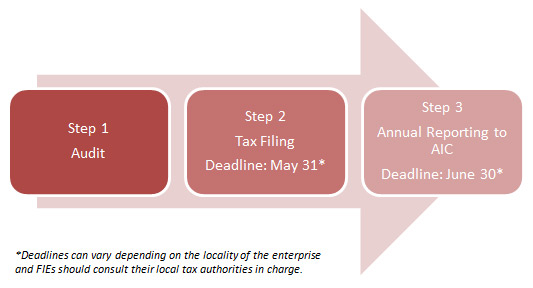

The annual compliance procedures involve audit, tax filing and inspection. These procedures are required by law, and completing them improperly could lead to fines. Furthermore, annual compliance is a good opportunity for companies to conduct an internal financial health check.

The annual compliance procedures and key considerations vary slightly by FIE type, generally falling into two groups:

- Representative offices (ROs); and

- Joint ventures (JVs), wholly-foreign owned enterprises (WFOEs) and foreign-invested commercial enterprises (FICEs).

In Beijing, there are two types of audits. One is the annual financial audit, or the so-called annual audit, which is conducted by a certified public accountant (CPA) firm and is applicable to FIEs (with the exception of ROs) for annual tax reconciliation purposes. The other is the annual tax audit, which is conducted by a certified tax agent (CTA) firm and is applicable to all ROs and some other FIEs that meet certain conditions in Beijing.

Other cities and regions may have varying requirements and clients should consult with their local tax authority in charge.

REPRESENTATIVE OFFICES

Step 1: Audit

RO Audit Document Checklist

(Requirements may vary by region; please consult Dezan Shira & Associates for details)

- Business License

- Tax Registration Certificate

- Enterprise Code Certificate

- Approval of opening of RMB basic bank account

- 2011 bank statements of both RMB and foreign currency accounts

- Tax Filing Method Assessment Form

- 2011 office lease agreement

- 2010 audit report (if available)

- Electric version of 2010 general ledgers, cash and bank journals, sub ledgers and vouchers

- 2011 tax payment notices of business tax and corporate income tax

- 2011 corporate income tax filing returns

- 2011 payroll and IIT calculation sheet of both Chinese locals and expats (photocopy)

- 2011 financial statements

- If revenue occurs, copy of related contract or agreement.

- RO staff information through the end of 2011

Key Considerations

Bank statements

The balance on your bank book should be the same as stated in the bank statement. If not, prepare a bank reconciliation to verify the differences.

Cash

The balance on your account should be the same to the physical cash in your cash box. The auditors will perform a cash count during their field work.

Staff and individual income tax

Employment of staff has to be registered in accordance with the pertinent regulations (local employees registered with FESCO and valid work permits for expatriate staff) and individual income tax correctly assessed and filed.

Expenses report

Audit fees, salaries, rentals, utilities, FESCO fees and any expenses belonging to the calendar fiscal year should be properly accrued with contracts or agreements as support. The total salary of the chief representative, whether paid offshore or locally, has to be included in the expenses. If employees are involved in overseas social security plans, these payments have to be included in the expenses report. Expenses paid on behalf of the head office may be required to be recorded into the expenses report.

Taxable income

On February 20, 2010, the State Administration of Taxation issued Guoshuifa [2010] No. 18 (Circular No. 18), which addresses the question of how representative offices of foreign enterprises in Mainland China shall file and pay PRC taxes. The Circular explicitly stipulates that ROs must pay corporate income tax on their taxable income, as well as sales tax and VAT, and will be required to assess CIT liability using the deemed profit method, cost plus method or actual revenue method. Among these three methods, the cost-plus method is the more commonly used to calculate deemed taxable income, since the other two methods require ROs to submit numerous supporting documents.

All expenses incurred by or related to the representative office must be included in the office expenses to calculate the deemed taxable revenue. Expenses include rent, transportation, telephone, salary, office purchases and entertainment, regardless of whether these are paid from the RO or directly from its head office. The total salary of the chief representative should be included in the representative office’s expenses.

Circular No. 18 raises the deemed profit rate from the original 10 percent to no less than 15 percent, rendering an increase to actual tax burden of ROs of more than 1.25 percent under the cost plus method (1.25 percent = 5 percent nominal increment of deemed profit rate × 25 percent CIT rate). Under this change, foreign investors should re-evaluate the actual tax burden of their ROs and reassess their business structures in Mainland China accordingly.

Circular No. 18, for the first time, requires the RO to follow the principle of proportionate functions and risks when calculating taxable income. It could imply that transactions between the RO and its head office should comply with the arm’s length principle, where relevant incomes, costs and expenditures should be accounted at fair prices. China’s transfer pricing regulations therefore are set to impose themselves on ROs for the first time.

Step 2: Tax Filing

The responsibility for tax filing in China is with the taxpayer. The tax bureau does not send out tax returns; rather the taxpayer has to collect and file tax forms according to the regulations. The tax authority requires that accounting records and ledgers be set up and kept properly and that details of the accounting system are filed.

ROs usually will need to submit the Annual Taxation Consolidation Reporting Package, authorized by a CTA firm licensed in China, to the tax bureau by the end of May each year. If the audited taxes due are found different from the taxes paid by the ROs, the ROs shall discuss the variation with the tax bureau. If you suspect this may occur, it is wise to hold preemptive discussions with your tax advisors prior to audit submission to smooth out any differences.

Step 3: Annual Reporting to AIC

On November 19, 2010, the State Council issued the “Regulations on the Administration of Registration of Resident Representative Offices of Foreign Enterprises,” which came into effect on March 1, 2011 and replaces the previous regulations that have been in force since 1983. The new regulations reveal special concern over the degree of business undertaken by ROs as well as their valid financial records. The Regulations require ROs to submit an annual report between March 1 and June 30 every year providing information on the legal status and standing information of the foreign enterprise, ongoing business activities of the RO, and an audited expenses report. The registration authorities will issue an RMB10,000 to RMB30,000 penalty if the RO fails to provide such reports on time, and an RMB20,000 to RMB200,000 penalty if the report includes false information. Fraud may also lead to license revocation. The impact of this is to effectively clamp down on the use of RO for quasi-trading purposes.

Content for this article was taken from the January/February issue of China Briefing Magazine, titled “Annual Compliance for FIEs.” Prior to distributing and repatriating profits, foreign-invested enterprises must complete annual compliance, involving an audit, tax filing and inspection. These procedures are not only required by law (and completing them improperly could lead to fines), but are a good opportunity to conduct an internal financial health check. We discuss all of this, in addition to clarifying expatriate IIT procedures, in the new issue of China Briefing Magazine which is immediately available as a PDF download on the Asia Briefing Bookstore.

Content for this article was taken from the January/February issue of China Briefing Magazine, titled “Annual Compliance for FIEs.” Prior to distributing and repatriating profits, foreign-invested enterprises must complete annual compliance, involving an audit, tax filing and inspection. These procedures are not only required by law (and completing them improperly could lead to fines), but are a good opportunity to conduct an internal financial health check. We discuss all of this, in addition to clarifying expatriate IIT procedures, in the new issue of China Briefing Magazine which is immediately available as a PDF download on the Asia Briefing Bookstore.

Dezan Shira & Associates is a boutique professional services firm providing foreign direct investment business advisory, tax, accounting, payroll and due diligence services for multinational clients in China, Hong Kong, India, Singapore and Vietnam. For further information on annual compliance procedures or tax filings in China, please email china@dezshira.com.

Related Reading

Doing Business in China

Doing Business in China

Our 156-page definitive guide to the fastest growing economy in the world, providing a thorough and in-depth analysis of China, its history, key demographics and overviews of the major cities, provinces and autonomous regions highlighting business opportunities and infrastructure in place in each region. A comprehensive guide to investing in the country is also included with information on FDI trends, business establishment procedures, economic zone information, and labor and tax considerations.

Setting Up Representative Offices in China (Fourth Edition)

Setting Up Representative Offices in China (Fourth Edition)

This is an essential, practical guide for any foreign enterprise or business-minded individual to understand the rules, regulations and management issues regarding establishing representative offices in China. This updated edition also includes detailed descriptions of the 2010 regulatory updates which have impacted on ROs.

The China Tax Guide (Fifth Edition)

The China Tax Guide (Fifth Edition)

This popular book, fully updated with all recent tax changes and amendments, details all taxes in China affecting businesses and individuals, how to calculate the amounts due, tax registration and filing procedures, tax minimization techniques, and claiming VAT rebates. It also details good financial management techniques, handling negotiations with the tax bureau and annual audit and compliance procedures.

2012 Annual Legal / Tax Documentation Renewals Due

China’s First Tier Cities Compete to Attract Foreign Headquarters

Roles and Responsibilities of the China Chief Representative

Roles and Responsibilities of the China Legal Representative

When Chief Representatives Can Be Barred from Office

- Previous Article China Vows to Increase Wages and Improve Employment

- Next Article Beijing Adjusts Maternity Insurance Policy