China’s First Tier Cities Compete to Attract Foreign Headquarters

Setting up regional headquarters in Shanghai, Beijing, Guangzhou and Shenzhen

Dec. 8 – China’s first tier cities – faced with various challenges during industrial upgrading and an economic transition – are scrambling to attract foreign-invested enterprises (FIEs) to set up regional headquarters (RHQ) in their jurisdictions.

The cities of Beijing, Shanghai, Guangzhou and Shenzhen have all announced regional incentives to attract foreign RHQs as they try and create cluster effects and optimize resource distribution.

Recognition of RHQs

In Beijing and Shanghai, two types of FIEs – investment holding companies and management companies – can apply for the RHQ status if they meet certain criteria.

According to the “Provisions on the Establishment of Investment Holding Companies by Foreign Investors (MoC Decree [2004] No.22)” released by the Ministry of Commerce (MoC) in 2004, applicants shall meet the following standards to apply for the establishment of a foreign investment holding company:

- 1) The foreign investor shall have its total asset value reach no less than US$400 million during the year previous to the year of application and own an FIE in China with a total paid-in capital exceeding US$10 million; or 2) Own no less than 10 FIEs in China with a total paid-in capital exceeding US$30 million

- In case of a joint venture, the Chinese investor shall have its total asset value reaching no less than RMB100 million during the year previous to the year of application; and

- The registered capital of the investment holding company shall be no less than US$30 million

Any foreign investment holding company that has already been settled in Beijing or Shanghai upon approval is eligible to apply for the RHQ status.

Foreign-invested management companies registered in Beijing and Shanghai shall meet the following criteria in order to apply for RHQ status:

- The total asset value of the parent company shall be no less than US$400 million

- 1) The parent company’s total paid-in capital in China shall be no less than US$10 million and the number of companies (in and outside China) the parent company is authorized to control shall be no less than three; or 2) The number of companies (in and outside China) the parent company is authorized to control shall be no less than six

- The registered capital of the foreign-invested management company shall be no less than US$2 million

Guangzhou has updated its RHQ recognition standards in 2010 and allows Guangzhou-registered FIEs with various functions – including investment holding, management, R&D and production – to apply for RHQ status if they:

- Have investment in, or are authorized to control, no less than three enterprises in and outside China

- Meet one of the following criteria:

1) Meet related capital/revenue/tax contribution standards specified for different industries in the “Guangzhou RHQ Recognition Standards (suifuban [2010] No.75)”

2) Invested in by a Fortune 500 company

3) Approved and established as an investment holding company

4) Included in the list of top 500 Chinese companies or the list of top 100 Chinese chain operators

5) Listed in the top 10 by business revenue among enterprises engaged in certain emerging strategic industries – such as new energy, information technology, new materials, life sciences and marine industries

Shenzhen-registered FIES which intend to apply for RHQ status shall meet the following basic requirements to start with:

- Engaged in industries that are encouraged in Shenzhen

- Receive no less than 30 percent of its business revenue from its subsidiaries

- Have no less than three subsidiaries outside Shenzhen

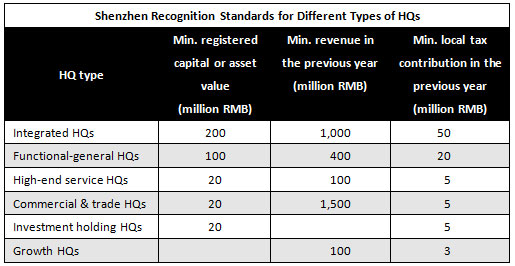

In addition to the basic requirements listed above, Shenzhen also specified RHQ recognition standards for FIEs of different sizes:

Favorable treatment to RHQs

The four cities’ local governments have granted various favorable policies to their RHQs.

1. Rewards/subsidies for RHQ establishment

- Beijing: A one-time subsidy amounting to between RMB5 million and RMB10 million for RHQs established after January 1, 2009 and with a registered capital of no less than RMB100 million

- Shanghai: A subsidy amounting to RMB5 million for newly-established RHQs

- Guangzhou: A one-time reward for RHQs established in Guangzhou in and after 2010; the reward amounts to 50 percent of the RHQ’s local tax contribution during the year when the reward is given

- Shenzhen: A five-year reward for newly-established RHQs; the reward amounts to 30 percent of the growth in the RHQ’s local tax contribution compared to the previous year

2. Rewards for high-revenue RHQs

- Beijing: A three-year reward for RHQs that see annual business revenue exceed RMB100 million for the first time

- Shanghai: 1) A one-time reward amounting to RMB10 million for foreign investment holding RHQs that see their annual business revenue exceed RMB1 billion for the first time; 2) A one-time reward amounting to RMB5 million for foreign-invested management RHQs that see their annual business revenue exceed RMB500 million for the first time

- Guangzhou: Rewards for RHQs with high (over RMB10 million in total) and fast-growing (increasing by RMB5 million from the previous year) local tax contributions

- Shenzhen: A one-time reward for RHQs that increase their capital by over RMB200 million; the reward amounts to 50 percent of the y-o-y growth in the RHQ’s local tax contribution calculated from the tax year following the capital increase

3. Subsidies on renting, building and purchase of offices

- Beijing: 1) A three-year subsidy for office rent, amounting to 30 percent, 20 percent and 10 percent of annual rents; 2) A one-time subsidy amounting to RMB1,000 per square meter for building and purchase of offices

- Shanghai: 1) A three-year subsidy on office rent, amounting to 30 percent of the standard annual office rent; 2) A one-time subsidy on building and purchase of offices; the subsidy amounts equally to the total of the three-year rent subsidy

- Guangzhou: 1) A one-time office rent subsidy amounting to 30 percent of annual market rent; 2) A three-year subsidy on building and purchase of offices; the subsidy amounts to 30 percent of the office property’s annual local property tax contribution

- Shenzhen: 1) An office rent subsidy amounting to 30 percent of the annual market rent; 2) A one-time subsidy on building and purchase of offices; the subsidy amounts to RMB1,000 per square meter of the office space

In addition to the aforementioned incentives, the four cities also offer rewards to key individuals at each RHQ, grant convenient visa procedures to foreign employees, and put preferential policies in place to support RHQ regional talent recruitment.

Dezan Shira & Associates is a boutique professional services firm providing foreign direct investment business advisory, tax, accounting, payroll and due diligence services for multinational clients in China. For further advice and specifics relating to setting up regional headquarters in China, please email china@dezshira.com, visit www.dezshira.com, or download the firm’s brochure here.

Related Reading

The China Tax Guide (Fifth Edition)

The China Tax Guide (Fifth Edition)

This popular book, fully updated with all recent tax changes and amendments, details all taxes in China affecting businesses and individuals, how to calculate the amounts due, tax registration and filing procedures, tax minimization techniques, and claiming VAT rebates. It also details good financial management techniques, handling negotiations with the tax bureau and annual audit and compliance procedures.

Shanghai City Guide

Shanghai City Guide

Asia Briefing’s City Guide on Shanghai is designed for the investor seeking a general overview on China’s most comprehensive industrial and commercial city. Due to its rapid economic growth in recent years, Shanghai is perhaps China’s most globalized city and, in addition to its role as Mainland China’s premier financial center, it is boasts an abundance of arts, culture, and cutting-edge technology.

Beijing City Guide

Beijing City Guide

Asia Briefing’s City Guide on Beijing is designed for the investor seeking a general overview on China’s political and cultural heart. Also one of the country’s most scenic and historical locations, Beijing’s numerous landmarks such as the Forbidden City and proximity to the Great Wall also make the city a wonderful place to live, work, or visit.

Shenzhen City Guide

Shenzhen City Guide

Asia Briefing’s City Guide on Shenzhen is designed for the investor seeking a general overview on China’s steadily growing tech city and important gateway to Hong Kong. Starting as China’s first – and eventually most successful – special economic zone, Shenzhen has seen vast sums of investment pour into the country both from abroad and from within China since the late 1970s.

Guangzhou City Guide

Guangzhou City Guide

Asia Briefing’s City Guide on Guangzhou is designed for the investor seeking a general overview on one of China’s largest cities. As capital of Guangdong, one of China’s most developed and prosperous provinces, Guangzhou is also the center of manufacturing in the region and hosts several important annual trade fairs.

- Previous Article China-India Business Update: Dec. 8

- Next Article China, India and Emerging Asia Tax Rates Compared