2012 China, India and ASEAN Growth to Stimulate Foreign Investment

China, India and ASEAN all key to FDI in Asia and obtaining corporate growth

Op-ed Commentary: Chris Devonshire-Ellis

Oct. 31 – Foreign direct investment trends are still on course to invest in the China and Asian markets in 2012, despite an upsurge in manufacturing costs in China. Although India is set to supplant China next year as the nation with the highest rates of growth, China is only marginally behind. The Chinese market has been hit by both a global slowdown and demand for products, as evidenced by the poor growth rates in the United States and Eurozone, in addition to a careful recalibration of its domestic economy to a more reliant consumer economy.

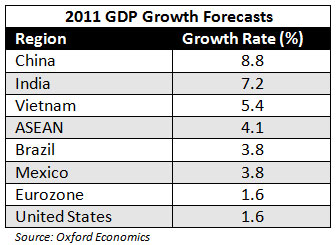

2011 GDP growth figures are expected to pan out with Asia leading global growth – headed once again by China, India and Vietnam. ASEAN, however, is expected to come down slightly from earlier forecasts of 6 percent growth primarily due to the intense flooding currently devastating Thailand, one of the region’s major economies. ASEAN, with its 10 member nations (including Vietnam), is a market of some 593 million in its own right, and has recently agreed to free trade agreements with China and India.

This same trend is expected to continue for 2012, albeit with signs of the U.S. economy picking up, which may also fuel a resumption of purchases from China. The Eurozone meanwhile continues a fairly dismal run. The figures indicate that in order to get growth into businesses based in North America and Europe, whose domestic economies remain sluggish, multinationals will have to continue to explore new markets, and especially those in Asia.

The significant factor is the rise of India which, like China, offers two solutions to the global manufacturing supply chain: a relatively cheap labor force (although India’s is now lower than China, this can be offset by as yet still inefficient infrastructure) and a thriving domestic market.

Interestingly, both China and India’s middle classes are about the same size, at some 250 million, with about 70 million in each country having the comparable spending power of individuals in developed Western Europe. Coupled with that, the population of ASEAN is about 20 percent higher than the entire European Union, with another 25 million earning Western levels of income. That’s equivalent to a total new consumer market able to purchase high value commodities of some 165 million, or roughly half that of the entire United States.

It is partly this driver that will dictate continuing foreign investment into China, as well as India and the ASEAN bloc. The ASEAN free trade agreements with China and India indicate that a three-pronged approach to dealing with these markets should be adapted as a longer-term strategy: with a base in ASEAN to maximize corporate residency benefits, the ability to use that to trade duty-free with China and India, and additional presences in each to facilitate sales to these markets. 2012, if not already on the agenda, should now be for corporate multinationals looking to expand into growth markets and develop new sales in profit-generating territories while Western markets remain sluggish.

Chris Devonshire-Ellis is the principal and founding partner of Dezan Shira & Associates. The firm specializes in providing foreign direct investment legal establishment, tax, cross border structuring and accounting advice across Asia, where it maintains 20 offices, including in China, India and ASEAN. Please email the practice at info@dezshira.com or visit the website at www.dezshira.com.

Related Reading

India Briefing News

India Briefing News

Our magazine and regular news service about doing business in India. We cover topics relating to the Indian economy, the market in India, as well as foreign direct investment and Indian tax and legal issues.

![]() Vietnam Briefing

Vietnam Briefing

Our magazine and regular news service about doing business in Vietnam. We cover topics relating to the Vietnamese economy, the market in Vietnam, as well as foreign direct investment and Vietnamese tax and legal issues.

Beijing Inks ASEAN Deal – 7,000 Products at Zero Tariff

China, ASEAN Negotiating Trade in RMB

Dezan Shira Opens New Office in Singapore

- Previous Article Shenzhen Introduces Favorable Policies to Promote E-commerce Development

- Next Article Banks Obtain More Incentives for Loan Offers to Small Businesses