Top 10 Things to Know about Doing Business in China

Jul. 29 – As one of the world’s largest emerging economies, China has garnered immense interest from international investors. In an effort to help potential investors and business-minded entrepreneurs overcome the seemingly daunting information barrier on establishing and operating a business in China, let us present our list of the top 10 most important things to know about doing business in this diverse and complex market.

Jul. 29 – As one of the world’s largest emerging economies, China has garnered immense interest from international investors. In an effort to help potential investors and business-minded entrepreneurs overcome the seemingly daunting information barrier on establishing and operating a business in China, let us present our list of the top 10 most important things to know about doing business in this diverse and complex market.

1. What business structure should I choose for investment in China?

Foreign investors have several choices when it comes to structuring a China enterprise, including the representative office (RO), the wholly foreign-owned enterprise (WFOE), the joint venture (JV) and the foreign-invested commercial enterprise (FICE).

Generally, the representative office can be used to get a feel for the market (but not conduct business activities), while the wholly foreign-owned enterprise (a more committed choice) allows greater freedom in business activities and more control over business operations, and is often used for manufacturing operations. A joint venture sacrifices the latter, but brings advantages of its own, including an ability to invest in otherwise restricted sectors. A foreign-invested commercial enterprise, an increasingly popular option, is a trading company, which permits the import and sale of foreign goods and services, as well as the export of Chinese products. They may also be used for franchising. When deciding between the options, you will need to address questions such as:

- What do you need to do in China now? What about a couple of years down the line?

- Do you need to hire your people on the ground and rent an office?

- Do you need to invoice locally for services or products?

- Are you getting a feel for the market or have you decided to commit to a larger scale operation?

- Are you planning to set up a trading or production-oriented entity or do you need only a representation in the country to carry out market research or liaison activities?

2. What sectors encourage foreign investment?

The Chinese government encourages, restricts and prohibits investment by sector, according to the demands and the needs of the country and the particular time. These sectors are detailed in the Foreign Investment Catalog, the most recent version of which is 2007. In April 2011, a new draft guideline for foreign investment was released by the Legislative Affairs Office of the State Council, but has not yet been approved. However, China has become increasingly liberal in the scope of activities permitted to foreign companies, and standard import/export and manufacturing businesses wishing to sell to the China market are unlikely to face many restrictions. Most barriers are in selected industries which either require a Chinese JV partner, or are off limits altogether in key areas such as military and other sensitive areas such as oil & gas, tobacco and some drugs. Most businesses will not come across restrictions.

3. Are representative offices still a good option for me?

From January 1, 2010, ROs are no longer exempt from corporate income tax in China. A circular issued by the State Administration of Taxation on February 20, 2010 explicitly stipulates that ROs must pay corporate income tax on their taxable income, as well as sales tax and VAT, and will be required to assess CIT liability using either the cost plus method or actual revenue method. ROs must submit an annual report between March 1 and June 30 every year providing information on its legal status and standing, ongoing business activities, and payment balance audited by accounting agencies.

The administrative regulations on ROs issued by the State Council that took effect in March 2011, specify that the activities that ROs are permitted to engage in include:

- Market research, display and publicity activities that relate to company product or services; and

- Contact activities that relate to company product sales or service provision, and domestic procurement and investment.

ROs are forbidden from engaging in any profit-seeking activities except for those which China has agreed on in international agreements or treaties. As such, an RO may not directly invoice for sales or services in China and can only interact with Chinese businesses indirectly.

As of 2010, a parent company must have been in existence for two years to establish an RO. RO can still be useful for pure market research and liaison activities, but these new regulations mean that RO are no longer the cost effective vehicle they used to be, especially given their constraints regarding trading activities. Companies now would be advised to set up a FICE or a WFOE instead.

4. What can I do to protect my intellectual property rights in China?

China is a “first to file” jurisdiction, meaning the law protects the party who is successful in first registering the trademark or patented technology/design, as opposed to the party who first used it. This means that you should take action to protect your intellectual property rights as soon as possible and definitely before Chinese market entry. It is alarming how many companies do nothing to protect themselves, even though they are fully aware of the IPR related risks in China. IP protection should extend to web domains, trademarks and patents, and these should be catered for through filing in China. China is however a signatory to the various international protocols and does follow the normal filing and category procedures familiar to most foreign investors. However, copying is rife and legal action expensive. Every business plan should include caution and attention to detail in getting registrations completed.

5. What are the main guidelines for labor contracts in China?

In June 2007, China’s top legislature, China’s top legislature, the National People’s Congress, adopted a new labor contract law that became effective January 1, 2008. Among other key points, this law protects workers’ legal rights by demanding a written contract. A written contract between the employer and employee is required; if no contract is provided then the employment relationship will commence from the employee’s first day of work.

An employer who fails to provide such a contract after one month will be forced to pay the employee twice their monthly salary. The law only allows for two continuous fixed term contracts and any further contracts must be, in general, open term contracts, which make it significantly harder to fire an unsuitable employee.

In addition, the Central Government has determined to effectively double the minimum salary level in China within the next five years, meaning mandatory salary increases of about 20 percent annually. Both the new labor law and the raising of minimum salary levels are having the effect of increasing labor costs in China and making it more expensive to dismiss employees. Human resources management and administration is therefore now an important part of any medium-large size investment into China.

6. What are the mandatory additions and special circumstances of labor payments?

The company is required to pay mandatory welfare or social security payments for each employee, including pension, medical, unemployment, injury, in addition to maternity to local hires. Many cities also require mandatory housing fund contributions. These payments vary regionally, but are generally an additional 30 percent to 50 percent of monthly salary. China’s new Social Insurance Law, which includes foreign employees in some of these payments, officially came into effect on July 1, 2011, but has yet to be clarified and implemented. It is important that these costs are built into the business plan as part of operational costs, it is a common mistake to omit them.

For overtime payments, the labor law states that employees must not receive less than 150 percent of their normal wage for extensions of regular working days; not less than 200 percent in extensions on days of rest; and not less than 300 percent for extension during statutory holidays. In addition, China has a relatively high level of national holidays and companies must factor in attention to detail concerning these.

7. What are some prevalent inaccurate accounting practices to be aware of?

A common method of tax avoidance rampant in (but in no way unique to) China is under-reporting accounts receivable in an attempt to hide sales to reduce taxable income. A slightly more country-specific accounting practice is multiple sets of financial accounts, which is rampant. While these multiple books are quite often used to avoid tax, they are also sometimes used to cover up other inappropriate financial behavior within the company itself. Moreover, often the official set of accounts are prepared electronically whereas the other set is maintained manually, and accordingly, it is often very difficult or impossible to reconcile these accounts. Due to the structuring of China’s tax laws and the liability window of these, local staff may commonly break the law to “assist” the company cash flow. Diligence, training and monitoring of accounts prepared by local staff need to be maintained. Fines for non-compliance can be as much as five times the original amount due plus the due amount.

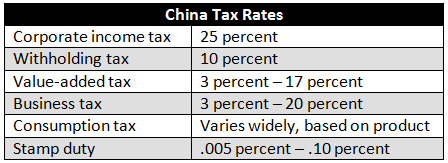

8. What are the main taxes and tax rates to be concerned with?

9. How does value-added tax work in China?

All enterprises and individuals engaged in the sale of goods, provision of processing, repairs and replacement services, and import of goods within China shall pay VAT. The VAT rate for general taxpayers is generally 17 percent, or 13 percent for some goods. For taxpayers who deal in goods or provide taxable services with different tax rates, the sale amounts for the different tax rates shall be accounted for separately.

The sales threshold for small scale taxpayers is RMB500,000 (for enterprises engaged primarily in the production of goods or the provision of taxable services) and RMB800,000 (for enterprises engaged in the wholesaling or retailing of goods). Non-enterprise units and entities that normally do not engage in taxable activities are given the choice whether or not they are taxed as small-scale taxpayers while individual (natural person) taxpayers with business turnover exceeding the threshold shall continue to be taxed as small-scale taxpayers. It is important to note that for small-scale tax payers, a scheme is operational that may require them to lodge a VAT “bond” with customs prior to being granted a VAT license. If so, this amount needs to be included as part of the initial business plan. China also has an extensive VAT rebate system, applicable upon export, although not all the VAT paid may be refunded. Typical rebates also take some time to process, so attention to detail concerning operational cash flow needs is required as part of the business plan.

10. What are exchange controls like?

China has tight exchange control policies. After a foreign-invested enterprise receives its business license, it is required to conduct registration with the State Administration of Foreign Exchange (SAFE), upon which a “Foreign Exchange Registration Certificate” will be issued to the enterprise. The Certificate is required for the opening of a foreign capital bank account and when handling all foreign exchange related matters. Where the foreign investor wishes to inject additional funds into the Chinese entity when increasing its registered capital, it must also apply to the SAFE for doing so.

As for repatriating profit and dividends, the enterprise must submit receipts proving that corporate income tax payments have been made in full, an annual audit report, a board resolution on the distribution of profit and dividends, a capital verification report, and the Foreign Exchange Registration Certificate. Dividends from profits are subject to a 10 percent withholding tax. A lower withholding rate may be applicable under double tax treaties.

Dezan Shira & Associates is a boutique professional services firm providing foreign direct investment business advisory, tax, China accounting, payroll and due diligence services for multinational clients in China, Hong Kong, Vietnam and India. For more information and advice regarding setting up and operating in any of these markets, please email info@dezshira.com, visit www.dezshira.com, or download the firm’s brochure here.

Related Reading

Doing Business in China

Doing Business in China

Our 156-page definitive guide to the fastest growing economy in the world, providing a thorough and in-depth analysis of China, its history, key demographics and overviews of the major cities, provinces and autonomous regions highlighting business opportunities and infrastructure in place in each region. A comprehensive guide to investing in China is also included with information on FDI trends, business establishment procedures, economic zone information, and labor and tax considerations.

The China Tax Guide (Fifth Edition)

The China Tax Guide (Fifth Edition)

This popular book, fully updated with all recent tax changes and amendments, details all taxes in China affecting businesses and individuals, how to calculate the amounts due, tax registration and filing procedures, tax minimization techniques, and claiming VAT rebates. It also details good financial management techniques, handling negotiations with the tax bureau and annual audit and compliance procedures.

Setting Up Representative Offices in China (Fourth Edition)

Setting Up Representative Offices in China (Fourth Edition)

This is an essential, practical guide for any foreign enterprise or business-minded individual to understand the rules, regulations and management issues regarding establishing representative offices in China. This updated edition also includes detailed descriptions of the 2010 regulatory updates which have impacted on ROs.

Setting Up Wholly Foreign Owned Enterprises in China (Third Edition)

Setting Up Wholly Foreign Owned Enterprises in China (Third Edition)

This guide provides a practical overview for any business-minded individual to understand the rules, regulations and management issues regarding establishing and running a WFOE in China.

Setting Up Joint Ventures in China (Third Edition)

Setting Up Joint Ventures in China (Third Edition)

Starting with choosing a joint venture structure, assessing a potential partner, and conducting legal and financial due diligence, this guide walks you through, step-by-step, the key points of setting up a joint venture in China.

Trading and Establishing FICE in China

Trading and Establishing FICE in China

In this issue of China Briefing Magazine, we evaluate the suitability of ROs, walk you through the details of FICE (including establishment procedures), discuss franchising in China for foreign companies, and put in a few words about the Chinese consumer from a macroeconomic perspective.

- Previous Article China to Learn Multilateral Negotiations in Mongolian Venture

- Next Article U.S. to Cooperate with China on Deporting Corrupt Fugitives