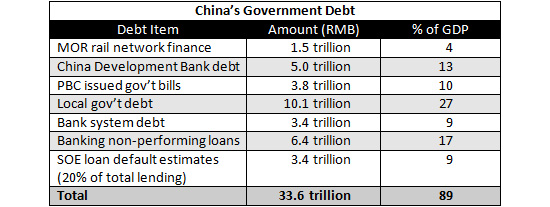

China’s Gov’t Debt Higher than Portugal at 89%?

Bears arriving as money is to be made from financial weakness

Apr. 22 – China’s government debt may be higher than that of recently insolvent Portugal, according to a new analysis released by research firm Dragonomics. The figures are in sharp contrast to the generally quoted government rate of 17 percent. Portugal, which has had to go to the IMF to seek a financial bailout, has a level of government debt of 83 percent, while battered economies such as the UK at 77 percent and Egypt at 74 percent are all lower than the purported China figure.

The assessment by Dragonomics of such a worryingly high debt figure has not been achieved through normal calculus, adding in central bank bills as part of government debt. However, the research house argues that as the People’s Bank of China is not independent from the central government, its debt ought to be reassessed and included. Dragonomics came to their figure by taking the official government rate of 17 percent debt and overlaying them with the following factors:

Such a public debt level is comparable with the United States, which is at 92 percent, and can be considered as a critical level. However China differs in that its financial system is strictly controlled and it operates a closed capital account, meaning that a financial crisis caused by such high levels is unlikely. However, levels at this rate, if correct, will undoubtedly impact on the performance of China over the next decade. Such debt levels would prevent the opening up of its financial systems to external factors and investment and potentially lead to economic stagnation.

The situation is apparently attracting bears to the market, and especially when it comes to Mainland China. The London-based research house Data Explorers have released security financing statistics demonstrating that the market in Hong Kong, as regards Mainland China stocks, has been getting short, declining by 2 points. Companies, including some of China’s medium sized banks, have been exposed to short selling over the past few weeks in signs that analysts are becoming more critical on China plays.

Meanwhile, George Soros, who was blamed for the Asian Financial Crisis in 1997 by shorting a number of currencies, and John Paulson, who more recently shorted U.S. sub-prime mortgages before the Global Financial Crisis, have both just opened branches of their operations in Hong Kong.

Hedge fund management businesses operating in Hong Kong and licensed by the SFC now number 538, as against just over 100 in 2004. The question is, does this signal that the experienced global bears are arriving to dissect the mainland asset and debt markets – and if so, when will they start to bet against it?

Related Reading

China Bears Gathering as Analysts Question Economy

NPC and 12th Five Year Plan – China’s Leaders Pass the Buck

- Previous Article Eurocham Releases Damning China Procurement Report

- Next Article Report: Online Supermarkets in Shanghai Popular Among Young, Affluent