PBC Announces 0.25% Interest Rate Hike

Apr. 7 – The People’s Bank of China (PBC) has just announced another raise in its benchmark interest rate of 0.25 percent, starting on April 6. It has been the central bank’s fourth interest rate hike since the beginning of 2010.

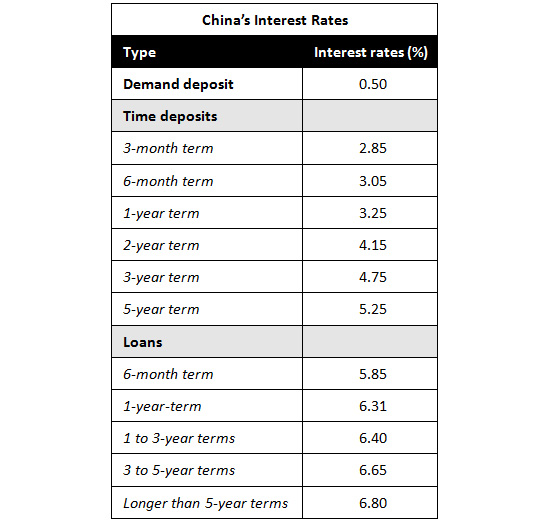

After the PBC’s announcement, the one-year term deposit interest rate in China’s financial institutions reached 3.25 percent, and the one-year term lending rate hit 6.31 percent. The deposit and loan interest rates with different durations are as follows:

The recent interest rate lift has been long and widely expected, as the market worries that China’s March consumer price index (CPI) will mark a record high again. In addition, due to the surging prices of international bulk stock, the producer price index (PPI) will stay high too, economists say.

The recent interest rate lift has been long and widely expected, as the market worries that China’s March consumer price index (CPI) will mark a record high again. In addition, due to the surging prices of international bulk stock, the producer price index (PPI) will stay high too, economists say.

The PBC has also noted the risk of excess liquidity, as China’s M2 has reached two times its current GDP. The excess money supply is one of the major reasons why China has decided to tighten its monetary policy.

However, the raises in interest rates and reserve requirement ratio might become a double-edged sword. On one hand, it exacerbates inflation; while on the other hand, it increases the financing costs of small and medium sized enterprises (SMEs).

The continuous interest rate increases have added extra costs to SMEs payback budget and will slow down their financing projects. Zhang Qizuo, vice president of Chengdu University, points out that SMEs will feel more pressure under the tightening monetary policy since they are faced with challenges from both the PPI surge and increases in financing costs.

For individuals who now may be thinking of moving their money to the Chinese banks, it is noticeable that despite a higher interest return, in general they are still losing money by placing their savings in the bank. The current one-year-term time deposit return is 3.25 percent – still lower than January’s CPI index of 4.9.

In order to offset the losses brought by the high inflation rate, many investors gave special interest to the investment in precious metals, agricultural commodities and energy commodities, so that they can resist the excess money supply and gain from the surging food and energy prices that have been leading the overall inflation. According to Bloomberg statistics, the global cotton price increased by 89 percent in 2010 and corn price augmented by 49 percent. Gold prices went up by 30 percent last year, and prices of silver and rake gold saw an 81 percent and 90 percent growth, respectively.

Related Reading

China to Further Liberalize Deposit Rate?

China’s Central Bank to Raise the Reserve Requirement for the Sixth Time this Year

- Previous Article U.S. and China Clarify IIT Treatment for Each Other’s Academic Workers

- Next Article Firms Conducting Temp Audits in China Need MoF License