China’s Indian City Equivalents and the Reasons for Going

The Bandra-Worli Sealink, Mumbai. India’s infrastructure is catching up.

Op-Ed Commentary: Chris Devonshire-Ellis

Oct. 29 – Interest in the China-India comparison has begun in earnest, and it’s not something that is going to disappear. While eyes have been on China for much of this year over currency issues, we finish 2010 with a U.S. presidential visit – but to India, where Barack Obama is visiting in a little over a week’s time. Inevitable China-India distinctions are going to be made, and you can bet that of these, a greater understanding of India, rather than China will follow.

I recognized the issues between the two countries several years ago, and was asked earlier this week why I’d decided to develop my practice out of China and into India. The reasons were as follows:

Personal development

At the time we already had seven offices in China (now increased to 10) and, as head of the business, it alarmed me that I wasn’t personally finding the opening of a new office in China so much of a thrill. That’s bad news for a COO, and indicative that I needed to go find a new challenge to keep me occupied – or leave the business.

Compatibility

I had a look at smaller regional markets such as Singapore, Mongolia, and even North Korea. However, when it came down to it, I figured that we really knew the following:

- We weren’t intimidated by huge countries

- We understood the implications and demographics behind a huge population

- We understand and make a living from emerging economies and countries with rapidly evolving investment laws, taxes and regulatory environments.

When we understood what we were and what we knew, the only compatible choice for us to expand into out of China was India.

Hedging

I also felt that continuously investing in China, effectively putting all of our eggs in one basket, could prove to be a strategic mistake if anything drastic went wrong in China. If, for whatever reason, investment into China slows, then I need to have an alternative market to take up the strain and even protect us if things get really bad.

Opportunity

I researched the India market for two years before we decided to incorporate. Operating originally from virtual offices in five locations, and with a very skeleton staff, I traveled the country all over trying to feel India and to get the pulse. Commuting between China and India is hard work, and I still had China issues to look after in the running of the business. But the more I was there, the more it made sense. We incorporated fully nearly four years ago, and upgraded virtual offices to fully fledged offices three years back, when we decided to make the investment permanent. It was made on the basis of government reforms, the size of the market, the changing demographics in China, and that “gut feeling” that it was the right thing to do. Now, we are set to initiate another tranche of investment into India and have, just this month, expanded our operations in both Mumbai and Delhi and recruited several more staff. From next year, our India operations are expected to provide dividends. I have successfully divested energies from China and into India with profitable results. And at the end of the day, that’s what business is all about.

That doesn’t mean that we are not bullish on China. We also opened a new office in Qingdao earlier this year. However, China is changing, as is India, and it is the latter changes that will be faster and require more attention than the China ones for the next three years. China is set on its course. India is about to see massive winds of investment blow through. Why? The size of the consumer market, which is larger than China’s, arguably more wealthy, and certainly more committed to spending, and its regulatory reforms (two examples, India is reducing its corporate income tax rate from 45 percent to 30 percent early next year, while the top rate for individual income tax will be lowered to 30 percent – as against China’s top rate of 45 percent).

So there I’ve covered the whys and wherefores and the processes. But what are Indian cities really like when compared with China? Let’s make some comparisons:

Rural land just one hour outside Mumbai

Shanghai vs. Mumbai

The main issue with Shanghai is that it gets referred to a great deal as “China’s financial center.” If so, it seriously lags behind Mumbai, and has for 20 years. Just during the past decade, 2000-2010, Mumbai’s Sensex has climbed 545.2 points against the Shanghai Composite’s 151.3. Put simply, for every dollar you’d have earned in Shanghai, you’d have earned 3.6 in Mumbai. A more complete report on the two markets can be found here. Mumbai is streets ahead of Shanghai in its financial maturity, profitability, and ability to deliver dividends to shareholders. J.P. Morgan, among others, also think so.

Fortunately for Shanghai, its bluster over being a financial center is in fact overrun by more practical considerations. It is the second largest port in terms of TEUs shipped in the world, behind Singapore, while Mumbai lies in 24th place – which is not too shabby. Mumbai is also being upgraded significantly, so expect to see that as a top 10 highest volume seaport within the next 10 years.

It’s also true to say that the service markets are different. Shanghai is a major port from which to reach the West coast of the United States, and markets elsewhere in Southeast Asia and Australiasia. For Mumbai, the markets of the Middle East and East Africa dominate, and Europe will progress once the global economy straightens itself out and the United States and European Union generate some growth. But for the time being, they are non-competitive, and dealing with different emerging markets of their own. In terms of growth, Shanghai can only try and compete with Singapore. Mumbai is where the growth and development will be.

Pavilion inside Delhi’s red fort, Old Delhi

Beijing vs. Delhi

Both capital cities, both recently having hosted major sporting events – we compared the Beijing Olympics with the Delhi Commonwealth Games here. Surprisingly, it’s New Delhi that is the prettier of the two cities. Built by Edward Lutyens to show off the imperial grandeur of the empire, he really went to town. It would be possible to contrast Old Delhi, that medieval maze of back alleys and rickshaws and bustle and hustle with Beijing’s old hutongs, but the Beijing city government knocked most of them down. In truth, that’s what should happen to most of Old Delhi. But for both, it’s the seat of government, although the nearby city of Gurgaon is going to become more on the map as investors pour in. It already possesses the third highest GDP in the country. While you’ll be familiar with Tianjin – Gurgaon is the Indian equivalent.

Rice cultivation in Chennai

Shenzhen vs. Chennai

Shenzhen epitomizes new China, built from scratch and now a city of 8 million, and the fourth largest port by TEU globally. Supported by Hong Kong and Taiwanese investors, it’s grown from just being where their local manufacturing industries moved to, to being a port servicing global supply. Chennai, however, is catching up. With a similar, slightly larger population of 8.5 million, it is located on India’s southeast coast, and has a slightly different demographic (its basically just across the ocean from Thailand). Its ability to also service the United States and Southeast Asia will make it a competitor over time with Shenzhen. Currently the 91st largest port globally, it is home to billion dollar investments by BMW, Nokia, IBM and HP, attracting a similar type of investment portfolio to Shenzhen. Roughly 60 percent of India’s auto exports go through Chennai, making it far more auto and IT focused than the residual low tech industries that Shenzhen is currently trying to divest itself from.

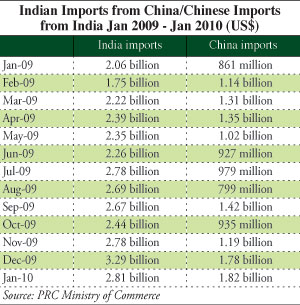

Comparisons of course can go on and on, and these above are only meant as snapshots rather than complete demographic examinations (but email us if you require such information). I’ve also provided some more rural than city photos to push home the point that India is not always about bustling cities and hordes of people. It remains, just as China does, largely a rural society, although this is changing as education is improved and, as is also the case with China, more people migrate to the cities. Finally, please find a breakdown of Indian imports from China, and Chinese imports from India. As bilateral trade and competition grows, the comparisons will keep coming.

Chris Devonshire-Ellis is the principal and founding partner of Dezan Shira & Associates, establishing the firm’s China practice in 1992. The firm now has ten offices in China, five in India, and two in Vietnam. For advice over China strategy, trade, investment, legal and tax matters please contact the firm at info@dezshira.com. The firm’s brochure may be downloaded here.

Chris also contributes to the Asia Briefing publications India Briefing, Vietnam Briefing, and 2point6billion.com.

Related Reading

![]() Emerging Asia – 2point6billion.com

Emerging Asia – 2point6billion.com

Our website devoted to specific China-India comparisons and developments throughout emerging Asia

Our sister website concerning matters of foreign direct investment, trade, law, regulatory environment, tax and operations in India

China-India Trade, Tax and Investment Comparison

China-India Trade, Tax and Investment Comparison

Complimentary report from 2point6billion.com detailing the procedural, operational and tax differences between Chinese and Indian representative, liaison, branch and project offices, as well as permanent establishments such as wholly foreign-owned enterprises, trading companies and private limited companies.

Our comprehensive guide to investing in India, including information on FDI trends, business establishment procedures, economic zone information and labor and tax considerations as well as an analysis of Indian business etiquette and culture. 156 pages, US$40.

Perceptions of India: Dirty, No Infrastructure and Poor (with images)

- Previous Article Xinjiang as a Central Hub for Investing in Russia and Kazakhstan

- Next Article New Issue of China Briefing: Mergers and Aquisitions in China