West China: Why FDI Should Consider the Region

Op-Ed Commentary: Chris Devonshire-Ellis

Sept. 2 – Following the conclusion of our series of articles about investing in China’s western regions, I believe that foreign investors would do well to look at these emerging markets in China. As sales markets in the United States and Europe remain stagnant following the global recession and growth remains slow, China’s western regions offer a way out. For sure, they are emerging markets in their own right, and possess their own pricing and cultural sensitivities. Yet they also represent a huge potential market in terms of volumes.

The sale of products to West China will require a definitive strategy, and possibly even a local Chinese partner familiar with the local customs and purchasing habits. Yet assuming the venture makes financial sense – a costing exercise combined with market analysis – international firms bold enough may also find themselves doing rather well. A lack of competition here from foreign brands makes this a market very much ready for development.

The other aspect West China brings to the foreign investor is more intangible; but businesses that have had success here become more emboldened in their approach. Suddenly what seemed unlikely, or even impossible, becomes a normal part of business operations. For businesses to grow, they must take risks and set challenges for themselves. Successfully executing them grows management skills, develops new confidence and breaks down barriers. In the case of West China, in many circumstances, knocking on the door can lead the business into other, new markets, such as Central Asia, or Southeast Asia.

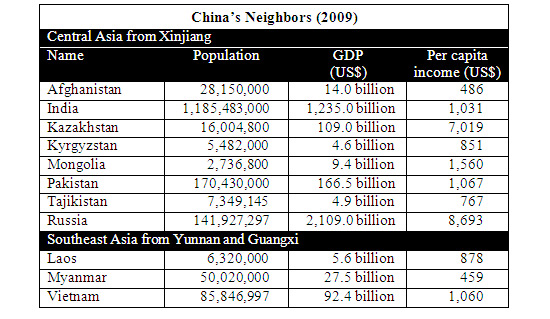

From Urumqi in Xinjiang, Dezan Shira & Associates has incorporated European companies involved in agriculture that had no market in Central Asia. Their initial plan was to export tomatoes back to Europe. Now, that business still sells back to their parent company, but sales of their products to Kazakhstan have made them a recognizable brand in the region. They are planning more products to capitalize on the opportunity. In certain areas, and this is especially true of emerging markets, you make your own luck. Just being in Xinjiang opened doors to markets they had not contemplated.

I’ve seen this story time after time in West China. In Yunnan and Guangxi, to the south, opportunities lie for the sale of products to the Southeast Asian markets and to ASEAN. With China having signed numerous tax treaties with ASEAN and its member states, a free trade zone has effectively been created that is resulting in very favorable tax conditions for China manufacturing and exports to the region. Exports from Southwest China can now easily be shipped to Southeast Asia.

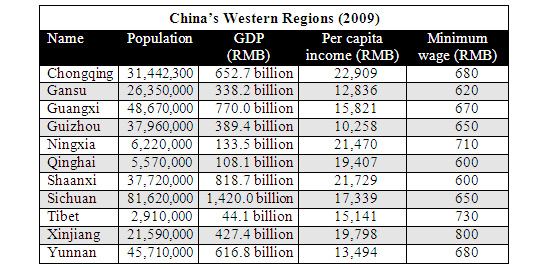

A lot of this makes sense, and not just for new investors to China. Existing investors may also start to eye up the western regions. Lower salaries, factory costs, and investment incentives for doing so all begin to creep into the equation in ways that the more familiar manufacturing centers cannot provide. At the end of the day, China is a manufacturing base dependent upon cost benefits. As these rise in the eastern provinces, it begins to make sense to evaluate the cost of business in the west.

That time, for many businesses, I suspect is now arriving.

Chris Devonshire-Ellis is the principal and founding partner of Dezan Shira & Associates, establishing the firm’s China practice in 1992. The firm now has 10 offices in China. For advice over China strategy, trade, investment, legal and tax matters please contact the firm at info@dezshira.com. The firm’s brochure may be downloaded here. Chris also contributes to India Briefing , Vietnam Briefing , Asia Briefing and 2point6billion

Related Reading

China Goes West

The China Briefing Guide to West China

- Previous Article New Foreign-managed Hotel to Open in Tibet

- Next Article Relocation Costs from China to India and Vietnam