Tax Filing for Outbound Payments in China: A Complete Guide

Tax filing for outbound payments is a prerequisite for the bank to process cash remittance applications for transactions that surpass specific thresholds and fulfill certain criteria. Presently, when an individual or organization in China makes a single outbound payment to overseas entities that exceeds the equivalent of US$50,000, the payer must complete tax filing for outbound payments with the local branch of the tax authority – the STA.

As cross-border transactions become increasingly common, outbound payments to overseas parties have become a standard practice for many businesses. On the other hand, however, outbound payments have always been under close scrutiny from the tax and foreign exchange authorities, which involves a series of compliance requirements. Among others, tax filing for outbound payments is a critical process.

In this article, we delve into frequently asked questions regarding tax filing for outbound payments. This includes understanding what tax filing for outbound payments involves, determining who is responsible for these filings, and outlining the proper execution of the process.

What is tax filing for outbound payments?

Tax filing for outbound payments is a process jointly required and managed by the State Taxation Administration (STA) and the State Administration of Foreign Exchange (SAFE) to monitor the foreign exchange capital flows and ensure the stability of national tax revenue.

Not all outbound payments are subject to the tax filing reporting obligation – only those exceeding a certain amount and meeting certain conditions are required to do so. For eligible transactions, tax filing for outbound payments is a prerequisite for the bank to process the cash remittance applications.

What kind of outbound payments are subject to tax filing?

According to the Announcement on Issues Relating to Tax Filing for External Payments of Trade in Services (STA SAFE Announcement [2013] No.40) and the Supplementary Announcement on Issues Relating to Tax Filing for Outbound Payments under Trade in Services and Other Items (STA SAFE Announcement [2021] No.19):

When a single outbound payment made by organizations and individuals in China to overseas parties exceeds the amount equivalent to US$50,000, the payer is required to complete tax filing for outbound payments with the local branch of the STA, if the money being remitted is of the following nature:

- Income from trade in services derived by overseas organizations or individuals in China. Typical services include transportation, tours, communications, contracting of building and installation services, insurance services, financial services, computer and information services, use and licensing of proprietary rights, sports, cultural and entertainment services, other commercial services, government services, etc.

- Work remuneration of overseas individuals in China.

- Dividends, bonuses, profits, direct debt interest, and guarantee fees derived by overseas organizations or individuals in China and non-capital transfer gains such as donations, compensation, taxes, incidental income, etc.

- Rent of finance lease, real estate transfer income, and equity transfer income derived by overseas organizations or individuals in China and other legitimate income of foreign investors.

What are the circumstances under which there is no need to make tax filing for outbound payments?

STA SAFE Announcement [2021] No.19 clarifies that no tax filing for outbound payments is required for the following matters:

- Reinvestments in China by a foreign investor with a legitimate income from its domestic direct investment.

- Non-trade and non-operational foreign exchange payments by agencies, public institutions, and social organizations funded with the financial budget.

In addition, Article 3 of the STA SAFE Announcement [2013] No.40 stipulates that the following outbound payments made by organizations and individuals in China to overseas parties are exempt from the tax filing formalities:

- Various travel, conference, trade exhibition expenses, etc. incurred overseas by a domestic organization.

- Office expenses of overseas representative offices of a domestic organization, and project expenses of overseas contracted projects of a domestic organization.

- Import and export trade commissions, premiums, and claims incurred overseas by a domestic organization.

- International transportation expenses derived by overseas organizations under import trade.

- Premiums, insurance expenses, and other relevant expenses under insurance items.

- Various repair, fuel, and port expenses incurred overseas by a domestic organization engaging in transportation or offshore fishery.

- Tour fee incurred by a domestic travel agency engaging in outbound tours and accommodation, transportation expenses, and other relevant expenses of bookings for outbound tours.

- Income or revenue derived in China by Asia Development Bank and international finance companies under the World Bank Group, including profits distributed by joint venture enterprises they invest in and income from the transfer of shares, income from the lease or transfer of properties (including real estate) in China, and interest on loans obtained by a domestic organization.

- Interest in foreign government (conversion) loans provided to China by foreign governments and international financial organizations (including foreign government hybrid (conversion) loans) and loans by international financial organizations. International financial organizations referred to in this item shall mean the International Monetary Fund, World Bank Group, International Development Association, International Fund for Agricultural Development, European Investment Bank, etc.

- Interest in external financing, such as overseas loans, overseas interbank borrowings, overseas advance payments made and other debts by designated banks with foreign currency operations or finance companies.

- Foreign aid funds donated by State agencies of provincial level and above in China.

- Payment of dividends, bonuses, and interest income by domestic securities companies or depository and clearing companies to overseas organizations or individuals pursuant to the law and proceeds from the sale of securities.

- Personal use of foreign currency for overseas study, travel, relative visiting, etc. by domestic individuals.

- Foreign exchange refunds under trade in services, gains, and current transfers by organizations and individuals in China

- Any other circumstances stipulated by the State.

What are the channels of making tax filing for outbound payments?

When a company is preparing to make a payment exceeding US$50,000 or equivalent and meet other conditions, it should first register and file the necessary tax information with the tax authority. This includes registering the company information, contracts, and taxable situations, as well as completing the payment of corresponding taxes, and registering and filing the outbound payment plan so that the bank can verify the tax filing information when processing the payment application.

Currently, there are two channels to go through the tax filing formalities:

- Channel I: Making tax filing for outbound payments at the tax service center of the local tax bureau. For a filing party that opts to complete filing formalities at a tax service center, if the materials submitted are complete and the Filing Form is filled in completely, the tax authorities in charge need not examine and approve tax matters on the spot, instead, they shall enter the information of the Filing Form in the system, and generate a serial number for the Filing Form and a verification code.

- Channel II: Making tax filing for outbound payments through online channels such as the e-tax bureau. Where a filing party opts to complete filing formalities online through an e-tax bureau, etc., it shall fill in the Filing Form completely and truthfully and submit the relevant materials. Upon completion of filing, a serial number for the Filing Form and a verification code will be generated as well.

What are the procedures for online tax filing for outbound payments?

The detailed procedures may vary from one city to another. Below we take Shanghai as an example to provide a step-by-step guide.

Step 1: Log in to the e-tax bureau and find the right column

Electronic tax bureau – I want to handle tax – certificate issuance – service trade and other projects’ foreign payment tax records.

Step 2: Fill in the Filing Form

The filing party shall fill in the Filing Form for outbound payment according to their actual situation. The filing party may choose a bank in this municipality or a bank in another province or city to handle outbound payments. When the filing person chooses a bank in another province or city, they may manually enter the bank’s business outlets. To be noted, detailed information about the bank is required, such as XX Bank XX branch (XX business department).

After the tax filing is successfully handled, a message with a serial number for the Filing Form will be sent to the contact’s mobile phone. It is essential to ensure the contact number is correct. If there is any problem, the mobile phone number can be modified through “User center – Account center – Personal Information management – Mobile phone number modification”.

Upon completing the tax filing, please click “Next Step”.

Step 3: Upload documents

According to the STA SAFE Announcement [2013] No.40, when the filing party handles tax filing for outbound payments, they should submit a notarized copy of the contract (or agreement) or relevant transaction documents with an official seal to the competent tax authority during the initial payment filing. If the same contract has been previously filed and the necessary documents have already been submitted, it is not mandatory to provide a copy of the contract or relevant transaction documents. After uploading, click “Next Step”

Step 4: Preview and submit

The system will provide taxpayers with a preview of the completed form information and supplementary material (which can be toggled using the tabs at the top of the page).

If you encounter any issues, you can click “Previous Step” to make modifications. If everything appears correct, click “Submit.”

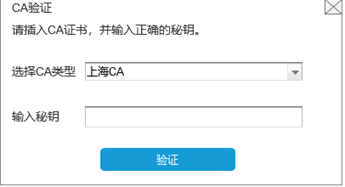

Insert the CA/IA certificate, and enter the private credential for signing.

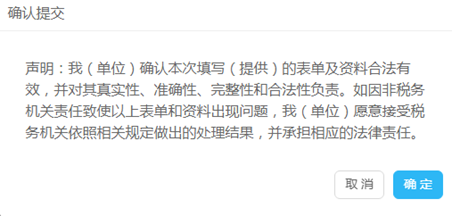

After clicking “Verify,” a confirmation message will appear again. Click “Confirm.”

After successful submission, you can click on “View My Application Information” to review the form details you just filled out. Alternatively, you can click “Revoke Application” to cancel the tax filing application for outbound payments. The status of relevant tax filing applications (such as “Applied but not verified,” “Verified,” “Not verified,” “Revoked,” or “Invalidated”) can be checked through the “Item Progress” section on the homepage of the tax desktop. You can also inquire about the progress and results by selecting “I Want to Inquire” and then choosing “Tax Progress and Results Inquiry.”

What are the subsequent formalities after the tax filing?

The filing party may complete foreign exchange payment formalities with the bank according to the relevant foreign exchange control provisions by submitting the serial number of the Filing Form and the verification code. The bank shall verify the tax filing for outbound payments through the Digital Foreign Exchange Management Platform.

How to deal with multiple outbound payments under the same contract? Is it required to make tax filing before each payment?

According to the STA SAFE Announcement [2021] No.19, domestic organizations and individuals who need to make multiple outbound payments for the same contract are only required to complete tax filing formalities before making the first outbound payment.

How to deal with errors found in the Filing Form after completing the tax filing? What if the filing items have changed?

When the outbound payments haven’t been made, the filing party can choose to modify or cancel the Filing Form at the tax service hall or through electronic channels. If the outbound payments have already taken place, the Filing Form cannot be voided and can only be amended.

The information provided is for general purposes only and may not account for local variations. No liability is assumed for the completeness or accuracy of the information. For personalized advice on specific business queries, consult our experts at Dezan Shira & Associates by emailing china@dezshira.com.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article January – February 2024 Economic Roundup

- Next Article Highlights from China FM Wang Yi’s Visit to New Zealand and Australia