Chris Devonshire-Ellis – The China Year in Review and Looking at 2016

In this 2015 year end annual review I assess the practical issues concerning the China slowdown, the comparisons with other Asian FDI markets, the reasons why China CEOs cannot now be held fully responsible for assessing the China market, the state of play concerning the evolution of the foreign invested professional services industry in China, provide some glimpses of how our own business operations have performed, and take a look at what 2016 may hold in store. But first, let me justify the reasons why my practice in particular is a useful primer as concerns China and Asian FDI trends.

Dezan Shira as a Benchmark China FDI Practice

Firstly, Dezan Shira & Associates is one of the oldest established independent professional foreign firms in China, incorporated in the country since 1992. Next year represents our 24th year of operations. Secondly, we are one of the largest of the privately owned practices in China, with some 12 China offices and several hundred professional legal and tax personnel. No-one else – except for the blue chip international law practices, the Big 4 audit practices and the recent VC funded practices – comes close. Third – in assessing China, we are also able to put it into context with the rest of Asia – a unique ability very few other firms can match. Our firm possesses offices in India as well as Vietnam, Singapore and liaisons across ASEAN – meaning we are not China-Centric, allowing us to effectively see the wood through the trees.

Fourth, our client base – numbering thousands of foreign invested clients over the years – is almost exclusively foreign investors. Of these, some 50 percent are American, plus about 35 percent from the EU, with the balance being made up of all other nations. Finally, within our own China Briefing facility – part of our wider Asia Briefing service, we employ numerous in-house researchers and analysts. We are able to conduct deeper analysis than most other professional firms as a result of this. Just a quick glance at our India Briefing, ASEAN Briefing and Vietnam Briefing portals will give you an idea of that depth. Both Dezan Shira & Associates and China Briefing are professionally run and funded resources, and unusually for a practice, made publically available and geared towards those same professional resources.

The China Slowdown Was Predicted, and Inevitable.

This past twelve months turned out to be the occasion when finally, predictions of problems within the Chinese economy started to really manifest themselves. While many foreign investors and analysts have expressed surprise at the depth of the slowdown, we wrote back in August 2012 that China’s own growth statistics were problematic and likely to be announced to fit Government requirements as opposed to reality. A slowdown also looked increasingly likely and Government statistics increasingly fudged when one considered that no economy could continue to grow at rates of 8-10% indefinitely. It is, and remains, an impossibility, so talks of the GDP growth rate being sustainable even four years ago looked fanciful.

From that time, our own firm’s business model has been cautious of China growth predictions, and we have looked at overseas markets to sustain growth, suspecting that China’s growth would not be sustainable at 8% for much longer. Since then we have written about the need to develop China manufacturing capacity into markets such as India and Vietnam on numerous occasions. In fact, China wants India to develop as a manufacturing hub, as I wrote earlier in the year here, while Vietnam’s development as a competitor to China has long been underway. Meanwhile, China’s growth has indeed slowed, and as I again noted earlier in the year is probably more along the 3-4% mark than the stated goal of 7.8%. These predictions and statements can be traced back to that internal diligence I explained is within our practice, combined with good old fashioned common sense and experience. China’s slowdown should not have been any surprise. The fact that in certain quarters it has been can be placed firmly at the door of one group of people – the China consultants and Chinese CEOs.

When Assessing China, Don’t Just Listen To Your China Guys.

I asked, again way back in 2012, whether your China business had become too China-Centric. As can now be seen, issues external to China are now dictating what happens with foreign investment into the country. The purely China-focused CEO can no longer see what is happening in China, as the country is too impacted by developments in Asia and the United States. Chinese staff and managers too will opt for China out of a lack of real knowledge, and/or patriotic duty rather than express any China investment concerns, and especially if these involve competing countries. Obtaining your China strategy from talking solely to your China based staff is no longer viable or appropriate, regardless of how long they’ve been in situ. Today, making comparisons with other markets and what is happening with trade agreements globally is needed to truly assess the impact of what is happening in the PRC. Getting your China strategy right is now increasingly an Asian and Global play. Suggestions that working out what will happen in China investment can be happily left to China based personnel diminishes both hard investment intelligence and China’s increasing global importance.

From The Horse’s Mouth – China FDI Remains Strong, But Regional Divisions Appear

To that end, then how did Dezan Shira’s own clients and the FDI products we sell to them behave during 2015? Our practice turns over tens of millions of dollars each year, almost all provided by medium sized MNC clients and where those dollars flow too are indicative of foreign investment trends. To that end, we can advise that while foreign investment into China remains healthy, and can be expected to remain so at investment rates in excess of USD100 billion per annum. Yet subtle changes are afoot. No-one it seems, is leaving China just yet, and our own China revenues grew healthily during 2015. However, increases in costs also came into the equation to eat into those revenue gains, and it became apparent a China north-south divide is also opening up. Put simply, while over the past 20 years we have seen growth at relatively equal terms across the China regions (we identify these as “Beijing & the North-East”, “Shanghai & The Yangtze River Delta”, “Guangdong & the Pearl River Delta” and “Sichuan & West China”) we now see clear signs of a retrenchment in the North-East. We handled more closures and liquidations in the North-East than anywhere else. Tianjin too, long a favored city for FDI due to the strength of the TEDA zone, took a hit after the chemical explosions earlier in the year. Clearly, rapid growth in these cities, even relatively advanced ones such as Tianjin, has come at the expense of basic safety protocols, while the air in Beijing is usually just dreadful – and dangerous. Thus far, the Central Government has been unable to reverse this trend, and in fact in turning over the approvals process for commissioning new coal power stations to local governments, has in effect, passed the buck. This does not auger well for any air quality improvements in China anytime soon – just a re-positioning of who, ultimately, is to blame. The new China normal in this regard is that of the Chinese citizens 5 star home prison or school prison – with air too dirty to breathe outside, citizens and schoolchildren have to remain confined indoors. Is that in itself healthy? Staunch expats will remain, while many have not left China, decamping instead to Shanghai. Air quality there too however is also deteriorating, yet at least 2015 showed that our clients enjoyed a successful year in East China. Our billings increased by beyond the national GDP growth level (yes, that official 7.8%) and FDI continues to arrive. The same is true for South China and the Guangdong region, although they do have the added arm to their businesses in the form of more easily being able to add capacity in nearby Vietnam. West China meanwhile showed negligible growth. Summing up, it suggests that FDI into China, and certainly when looking for growth and opportunity, will be concentrated in the South and East China regions into 2016.

China Investment Destinations Re-Assessed

It must now be a given that pollution is now a factor when assessing China as an FDI destination. Expats in Hong Kong prefer the better climes of Singapore, although even South-East Asia’s jewel appears somewhat powerless in the face of the slash and burning of tropical forests in Indonesia and Malaysia. Opportunities lie here, but only as soon as the Central Government steps up to the plate to make it a truly national issue and one requiring top priority, effectively meaning that pollution will only start to be addressed when it becomes a core Chinese policy to deal with it. The repercussions of not doing so appear to have been ill thought out. FDI is and will continue to be selective in China, moving into ‘safe’ regions around Shanghai and Coastal South China, which are already well developed and can be flushed out by ocean borne wind patterns. These areas will continue to boom. That does not however fit very well with the state policy of spreading wealth on a national basis. How that conundrum will be fixed remains to be seen – higher taxes on residents, and even restrictions on migrant workers in these areas. Meanwhile, should South China and the Yangtze River Delta remain the high spots, what about the rest of China?

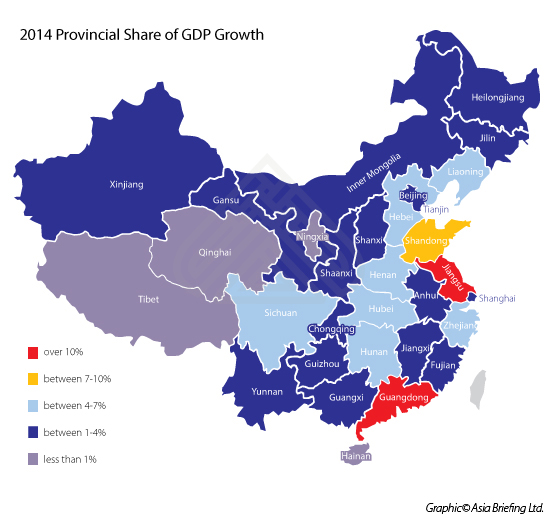

Indeed, China’s policy of maintaining border disputes is also coming back to bite it. China has disputes with every single one of its neighbors, the only distinction being the level of dispute at any given moment in time. It is a CCP strategy that is now proving to be a problem. Some of China’s most potentially dynamic provinces lie on its borders – Yunnan, with its border through to South-East Asia, Inner Mongolia through to Russia, and Xinjiang through to Central Asia –yet all are in a state of slow development. Part of the reason lays with the fault lines that exist between the Ministry of Foreign Affairs and the Ministry of Commerce. The MOC wishes to promote development with neighboring countries, the MoFA resists this. As a result, for example, there is little to no direct dialogue between for example, Kunming and Hanoi, despite them being just 340 miles apart. All contact has to go via Beijing. And with an unofficial yet obvious policy of continuing border disputes with neighbors, nothing much gets done in terms of improving trade and investment links. The same is true between Urumqi and Almaty (460 miles). Until China changes its State policy of sustained border disputes it will not be able to fully maximize its land border export potential, no matter how much infrastructure they build on their side of the fence. Current cargo volumes show that main overland border crossings between China and Russia, China and Kazakhstan and China and Vietnam are operating at about 10 percent of their capacity. China may have built the facilities, but it needs a change in policy to make these truly viable. In the meantime, foreign investors in China during 2016 are really limited to the main sea ports, and now that Tianjin has shown itself to be both non-compliant nor especially safe, that means being located near the main ports of Shanghai and Ningbo, as well as Guangzhou, Shenzhen and Hong Kong. 2016 will be a boom time for Eastern and Southern China. Last year’s graph of Provincial Share of GDP Growth effectively illustrated this, and the underlying message as we lead into 2016 is quite clear about the geographical hot and cold spots.

Vietnam and India Rising

South China over the past few years has undergone a restructuring and evolution of its own. In some ways it is rather separate from the rest of China in terms of it facing lower cost manufacturing competition right on its doorstep. Factories and investors in Guangdong have become used to these pressures in a manner for example that investors in Shanghai are not. The rise of Vietnam though poses questions for what is actually happening in South China. In short, this is a tax based free trade question with answers to be found in three different areas, depending upon the specific business deliverables. Firstly, how far will Vietnam reach in coming into ASEAN Economic Community compliance at the end of this month? Our view is that the AEC deadline, combined with upcoming profits tax reductions will provide a significant boost for determining the economics of manufacturing in Vietnam to resell to the Chinese market, as import tariffs will be reduced, and these, combined with Vietnam’s far lower production costs then make a case for placing part of the production facility into the country. Additionally, how will the proposed TPP agreement impact upon China, and US trade with Asia? The TPP deal will probably be delayed until after the 2016 US elections, which will not take place until next November, leaving plenty of room for scope and research. However, sensible businesses need to be assessing the rules of origin under the TPP and assessing how this impacts upon their products. Such observations are exactly what I mean when suggesting that China hands are not generally able to spot such trends – wider Asian knowledge is now required. I looked into the wider ASEAN position in this article “The ASEAN Option” – which includes overviews not just of the ASEAN stalwarts of Indonesia, Malaysia, Philippines and Thailand, but the other countries supposed to be coming into AEC compliance – Cambodia, Laos and Myanmar.

India too, is looming on the horizon. Savvy businesses have noticed that India has recently overtaken China in two main areas, the total amount of FDI received, and in GDP growth rates. I discussed India in the article – “The India Option”. Meanwhile, in a survey taken last month of all of Dezan Shira & Associates China based clients, some 17.7 percent of them had also invested in India, suggesting the China attitude towards the country as being difficult and problematic when compared to China is no longer true. It is worth noting that India’s middle class consumer base is about the same size as China’s at about 250 million. Yet ask most China hands about India, and they’ll be dismissive. Now more than ever, it is important to assess China in the context of Asia, and Global trade and investment, especially as the economy is slowing. Failure to do so risks missing out on other more lucrative markets and opportunities.

Where Else Do Our China Briefing Readers Go?

China Briefing achieved online views of well over a million unique visitors in 2015, the third successive year we have broken the million unique views barrier, and grew overall during 2015 at a rate of 8 percent YOY. That makes China Briefing by far and away the largest source of free access China online business intelligence. Competing blogs may dismiss us as ‘professional’ and not a blog, yet the impact of both our content and readership are highly influential, and increasingly so. China Briefing is an industry standard.

Patterns also emerged amongst readers now concerned with other markets, bearing out what we’ve been suggesting as regards getting more Asia knowledge into your China operations.

That renewed interest in India meant viewers to our India Briefing portal grew by 28 percent YOY, while Vietnam Briefing’s readership grew by 24 percent and ASEAN Briefing a whopping 128 percent. Coupled with the China Briefing total, it means we are attracting close to two million original views per annum. The spread of that readership tells its own story – China based foreign investors are increasingly looking at ASEAN and India for getting growth into their Asian operations, again illustrating what I’ve said – obtaining greater knowledge than just the sole China angle is becoming a key intelligence issue. The article “China Plus One – Where Foreign Investors Are Heading After China” last month both analyzes and explains this trend.

Professional Services Trends in China

China is stuffed full of foreign firms all vying for foreign investment dollars and to advise foreign investors into the country. Like all markets, there is a lot of jiggery pokery about, and not all firms are what they seem. However, 2015 was the beginning of the end for many of them, even if they don’t know it yet. Here’s my take on how things will pan out, with increasing levels of commitment from China itself to ensure these changes come about.

Legal Services in China

China issued new regulations in 2015 that effectively placed the legal services industry as solely being the remit of China licensed law firms. That means everything from trademark registrations, contract reviews and drafting, as well as incorporations (including representative offices) in addition to litigation and so on may only be handled by China registered firms. Foreign firms pretending to have China offices either via association or via a local company helping them will begin to suffer, either via price competitiveness offered by local Chinese firms, or by direct legal challenges to them. Foreign partners and foreign lawyers of firms not entirely operating in a legal manner in China may need to be careful.

The bona-fide foreign firms registered with the Ministry of Justice will find themselves increasingly pushed to form Joint Ventures with local Chinese firms. In fact, this process has already begun, effectively starting in 2012 with the merger of King & Wood with Mallesons. The process of moving foreign firms to comply with Chinese state wishes will come from two directions – the motivating of them by allowing legal services in lucrative areas such as finance to be permitted in special areas such as the Shanghai Free Trade Zone while on the other hand, challenging smaller players by encouraging local firms to compete or even requesting the PSB raid non-compliant offices of firms offering legal services outside this remit. I don’t expect the latter to happen immediately, but the writing is on the wall. The provision of legal services in China will eventually be only via bona fide Sino-Foreign Law JV’s. This means firms not able or willing to absorb this will need to find other markets, or adapt their practice area. But the era of small foreign firms pretending to be in China is drawing to a close, and there may be casualties. At the corporate end, more mergers will be announced.

Accounting Services in China

Standard accounting services is an old tech industry and is being overtaken by software developments. Eventually this entire service will be provided by banks, and charged for by them, and not by accounting practices. Some accounting firms have already been bought by some of the larger Asian banks. It will take time, but this is a dying industry globally as a stand-alone professional service.

Audit Services in China

The usual firms will dominate this industry, the Big Four plus players such as Grant Thornton and BDO, while we can expect to see the State sanctioned and encouraged mergers of local firms with the eventual aim of developing a local China practice able to challenge and compete with the Big Four over time. This evolution has already begun, with foreign invested auditors in China now being dominated by Chinese and not foreign partners.

Administration Services in China

Business administration, or what used to be known as “Company Secretarial” work is now becoming increasingly sophisticated n the global arena. It is an IT driven service, based on transaction volumes and especially cross-border work. What may be lumped into “outsourcing” to some extent fits into this category. It includes administrative services, such as Payroll, Treasury and certain HR processes, as well as fiducial and secretarial services. In fact this area has been the subject of multi-million dollar VC funding amongst various foreign invested, China based businesses in this category, with players such as TMF, Orangefield and Vistra. Dezan Shira & Associates also fit into this area, and are the largest remaining foreign owned, privately held business in China of this type.

These are all substantial businesses with growing global portfolios. This is a challenging and competitive market, from which three or four global players will emerge – China providing a large base to work from, but crucially, not the whole objective. As we have already seen, businesses are expanding into other markets, meaning significant players with pan-Asian and global ambitions will emerge by 2020, some of them with origins in China.

Smaller Private Practices

2015 may well have signaled the beginning of the end for many smaller foreign invested practices. Some have been riven by shareholder disputes and lawsuits, others have never really been able to rise to the challenge or become significant. These will eventually either be picked off by local Chinese practices better able to compete with lower fees, or will suffer from a lack of investment and inability to adapt. I predict at least one scandal potentially emerging involving smaller foreign owned firms conducting dubious business practices. The lucky ones with any sizable client base and crucially, profit margin, may find a home within one of the other firms, and it may be wise for them to attempt to do just that.

Summary

Businesses with solid cash flow and margins in China will continue to invest in their China businesses, while also increasingly looking at China alternatives. Drawing down on China funds and reserves to invest in markets such as Vietnam, India and elsewhere will become increasingly common. The knowledge and expertise needed to drive that investment will also become increasingly sought after.

2016 will also see its fair share of corporate failures, both foreign and Chinese, while the much vaunted statistic that shows that China’s outbound investment is now larger than its inbound investment will continue to make headlines, yet remain elusive and intangible for foreign politicians to actually grasp. China will continue to make friends and inroads into Russia, Iran and India, while foreign investors into China will prosper in the South and East. Overall however, 2016 is a year when pockets will need to be deep. Investment in China businesses will need to be increased just to sustain the opportunity and development costs, while at the same time maintaining a steady eye on investment opportunities just beyond China’s borders.

|

Chris can be followed on Twitter at @CDE_Asia. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

|

![]()

Tax, Accounting, and Audit in China 2015

Tax, Accounting, and Audit in China 2015

This edition of Tax, Accounting, and Audit in China, updated for 2015, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

An Introduction to Doing Business in China 2015

An Introduction to Doing Business in China 2015

Doing Business in China 2015 is designed to introduce the fundamentals of investing in China. Compiled by the professionals at Dezan Shira & Associates, this comprehensive guide is ideal not only for businesses looking to enter the Chinese market, but also for companies that already have a presence here and want to keep up-to-date with the most recent and relevant policy changes.

Selling, Sourcing and E-Commerce in China 2016 (First Edition)

Selling, Sourcing and E-Commerce in China 2016 (First Edition)

This guide, produced in collaboration with the experts at Dezan Shira & Associates, provides a comprehensive analysis of all these aspects of commerce in China. It discusses how foreign companies can best go about sourcing products from China; how foreign retailers can set up operations on the ground to sell directly to the country’s massive consumer class; and finally details how foreign enterprises can access China’s lucrative yet ostensibly complex e-commerce market.

- Previous Article Asia House Interview With Chris Devonshire-Ellis on China’s Silk Road Policy

- Next Article China Stock Market Suspension Ushers In A Tough 2016