Market Overview: The Medical Device Industry in China

China is currently one of the world’s most promising markets for medical devices. Sales of medical devices in the country reached RMB 200 billion in 2013, making it the second largest market in the world, according to the U.S. Commercial Service. Even compared to other sectors of the Chinese economy, the market in medical devices is one of the fastest growing market sectors in the country.

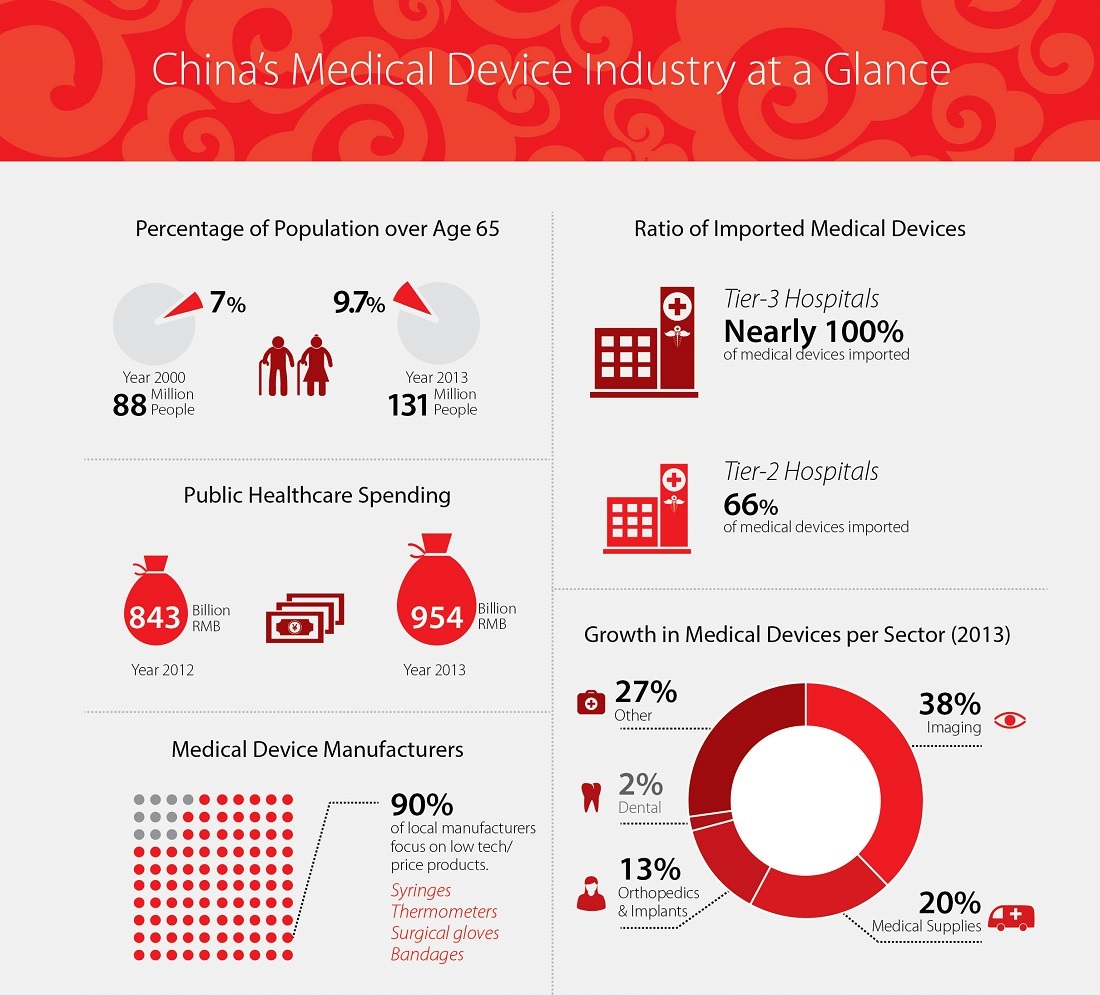

Due to the One-child policy, which only recently was made slightly more lenient, a growing share of China’s population will soon be over the age of 60, closely aligning its demographic dynamics with those of many developed countries. Alongside these changes, rising living standards have given rise to rapid growth in the demand for medical products and services. The Chinese government has made a priority of developing the health care sector as well, especially investing in the central and western parts of the country, where the quality of health care is lagging behind the rest of China.

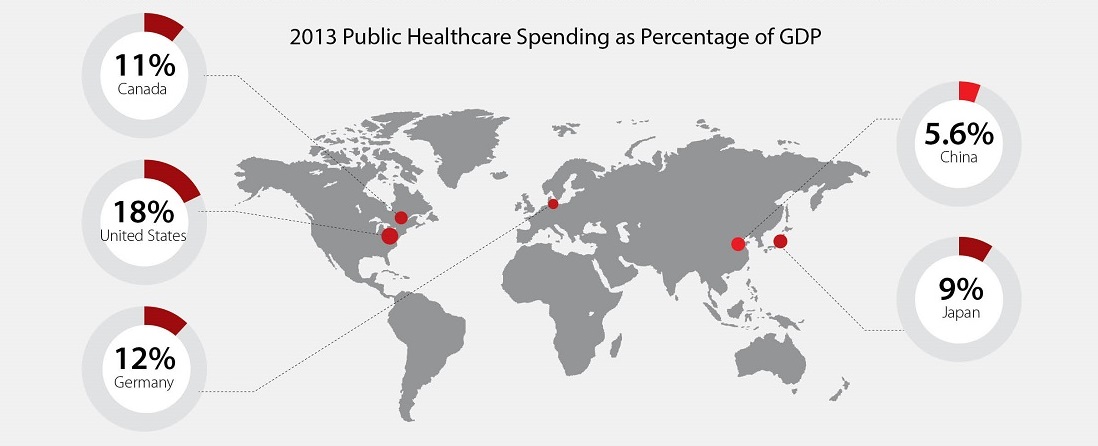

Despite a 20 percent increase in public spending on health care in recent years, China currently makes up only two to three percent of the global market for medical devices. Internationally, the respective markets for medicines and medical devices are of roughly equal size; however in China, the market for medical devices is only 14 percent of that for medicines.

Observers explain these extremely lopsided dynamics by pointing to the practice in Chinese health care of favoring treatment with drugs over medical devices, and a focus on treatment over prevention. These conditions have left a large part of the market underserved, which many believe may change in the near future, spurring even higher demand for medical devices.

![]() RELATED: Investing in China’s Healthcare Industry

RELATED: Investing in China’s Healthcare Industry

China relies heavily on foreign imports for its medical supplies and devices. This is especially true for high-tech, high-price items, for which the U.S., Germany and Japan serve as major exporters. Additionally, there are several thousand local manufacturers of medical devices – mostly small companies with low revenues – roughly 90 percent of whom are makers of low-tech products such as syringes and thermometers.

In contrast, the majority of high-tech equipment is imported into the country; for example, 80 percent of CT scanners, 90 percent of ultrasound equipment and 90 percent of MRI equipment is manufactured abroad. Imports of mid-to-high end products have decreased in recent years, but this has largely been due to foreign companies moving their production plants to China.

This discrepency between foreign and Chinese producers of medical devices is commonly attributed to the high entry barriers for the higher-end medical device market: producing more technologically advanced equipment is capital-intensive, requires a great deal of technical knowledge and generally has a longer time to market.

Faced with a lack of financing, many firms are unable or unwilling to make the investments necessary for moving into the higher ranges of the market. Often it is simply easier for domestic firms to copy foreign products, which has led to an upsurge in patent litigation in recent years.

Since 2009, however, there has been somewhat of a consolidation in the medical devices sector. Several companies have merged and gone on to take larger shares of the market, including the Wei Gao Group, Mindray, Yuwell, Microport, Le Pu Medical and Fosun Pharma. Some domestic companies have found success producing more mid-range products like monitors and cardiac stands, which they are often able to sell at lower prices than their foreign competitors.

According to the China Medical Pharmaceutical Material Association, imported medical devices tend to sell in China at prices 50-100 percent higher than in the countries where they are produced, making China an attractive market for foreign producers of medical devices. Foreign manufacturers also benefit from a general perception among Chinese consumers that foreign products are of better quality and worth paying a premium for. Lastly, imported devices typically enjoy higher brand recognition, with even public hospitals often deciding to purchase them despite the higher costs.

According to the China Medical Pharmaceutical Material Association, imported medical devices tend to sell in China at prices 50-100 percent higher than in the countries where they are produced, making China an attractive market for foreign producers of medical devices. Foreign manufacturers also benefit from a general perception among Chinese consumers that foreign products are of better quality and worth paying a premium for. Lastly, imported devices typically enjoy higher brand recognition, with even public hospitals often deciding to purchase them despite the higher costs.

This trend has recently led the China National Health and Family Planning Commission to announce the launch of a policy favoring local producers of medical devices, as a means of bringing down rising health care costs. The policy includes a list of locally produced medical devices that are specifically recommended by the Commission and are to be given preferential treatment by public hospitals.

The new policy is especially focused on getting the larger “Tier-3” hospitals to strengthen their procurement of locally produced products. Notably, these larger hospitals also frequently handle purchasing for smaller hospitals. In this light, the latest trends in Chinese state policy for the medical device industry may dissuade foreign investors from a purely distribution-based approach to the Chinese market.

This article is an excerpt from the November issue of China Briefing Magazine, titled “China Investment Roadmap: The Medical Device Industry.” In this issue of China Briefing, we present a roadmap for investing in China’s medical device industry, from initial market research, to establishing a manufacturing or trading company in China, to obtaining the licenses needed to make or distribute your products. With our specialized knowledge and experience in the medical industry, Dezan Shira & Associates can help you to newly establish or grow your operations in China and beyond. This article is an excerpt from the November issue of China Briefing Magazine, titled “China Investment Roadmap: The Medical Device Industry.” In this issue of China Briefing, we present a roadmap for investing in China’s medical device industry, from initial market research, to establishing a manufacturing or trading company in China, to obtaining the licenses needed to make or distribute your products. With our specialized knowledge and experience in the medical industry, Dezan Shira & Associates can help you to newly establish or grow your operations in China and beyond. |

![]()

China Retail Industry Report 2014

China Retail Industry Report 2014

In this special edition of China Briefing, we provide an overview of the retail industry in China and the procedures for setting up a retail shop, focusing specifically on brick-and-mortar physical retail stores. Further, we have invited our partner Direct HR to offer some insights on the talent landscape in the retail industry, as well as tips for recruiting retail personnel in China.

Adapting Your China WFOE to Service China’s Consumers

Adapting Your China WFOE to Service China’s Consumers

In this issue of China Briefing Magazine, we look at the challenges posed to manufacturers amidst China’s rising labor costs and stricter environmental regulations. Manufacturing WFOEs in China should adapt by expanding their business scope to include distribution and determine suitable supply chain solutions. In this regard, we will take a look at the opportunities in China’s domestic consumer market and forecast the sectors that are set to boom in the coming years.

Revisiting the Shanghai Free Trade Zone: A Year of Reforms

Revisiting the Shanghai Free Trade Zone: A Year of Reforms

In this issue of China Briefing, we revisit the Shanghai FTZ and its preferential environment for foreign investment. In the first three articles, we highlight the many changes that have been introduced in the Zone’s first year of operations, including the 2014 Revised Negative List, as well as new measures relating to alternative dispute resolution, cash pooling, and logistics. Lastly, we include a case study of a foreign company successfully utilizing the Shanghai FTZ to access the Outbound Tourism Industry.

- Previous Article Tax, Accounting, and Audit in China 2015 – New Publication from China Briefing

- Next Article Investing in China’s Medical Device Industry, Part 1

By

By