Intra-Asian Trade Flows to Help Global Economy Top US$100 Trillion by 2020

China and India-based trade corridors to pave the way

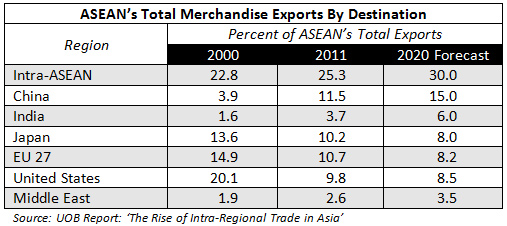

Nov. 29 – A report by the United Overseas Bank (UOB) of Singapore has indicated that the global economy will increase by 73 percent over the US$63 trillion seen in 2010 to reach US$109 trillion by 2020, with Asian trade flows one of the key factors contributing to this robust growth. Within Asia, bilateral trade corridors involving China and India will be the fastest growing sectors – leading the way for Asia (excluding Japan) to make up roughly one-third of the world’s total economy by 2020, double the region’s current levels.

The report, entitled “The Rise of Intra-Regional Trade in Asia” suggests that several trade corridors are opening up that are of immense significance to both Chinese and global trade. The fastest growing trade corridor globally will be India’s trade with the Middle East, whereas the fastest growing trade routes involving China are:

- China-India

- China-Africa

- Latin America-China

- EU-China

- China-MENA

- China-United States

- China-Asia

Concerning Asia, the report suggests that import demand from emerging Asia will increase as private consumption develops to become an important growth engine for the region. Structural factors supporting this theory include strong demographics, growth in disposable income levels, and increased urbanization throughout Asia. An explosion of middle class wealth across Asia is expected to launch a wave of spending power – good news for global manufacturers looking to break out of their domestic markets.

The establishment of free trade across ASEAN by 2015 is a major factor underpinning this evolution of higher intra-regional trade. We have written about these issues and the impact they will have on China and throughout Asia in our recent piece “China to Join RCEP Creating Massive Free Trade Area.” Although the free flow of most trade goods can be expected, there may still be some resistance to banking and telecommunications, although within ASEAN and its other trade partners such as China and India, talks are underway to find common ground. The statistics presented below are likely to resonate beyond 2020, however, as by that time the ASEAN member state Indonesia is expected to become one of the world’s top 10 largest economies, when its GDP alone is expected to reach US$3 trillion.

The UOB report also mentions that while the economies of the United States, European Union and Japan will remain important, they will continue to cede market share to global emerging economies over time. It also warned that while growth in emerging Asia was expected, the region would still be prone to development shocks and in some areas would remain volatile. It also noted that the EU Sovereign Debt Crisis and U.S. fiscal cliff issues were unlikely to impact upon Asian growth figures.

In terms of how this affects the United States, Asia’s growth in domestic consumerism represents good news for American manufacturers, as we pointed out here. In this piece (which outlines how American companies have performed in China during 2012), we show that American businesses are increasingly entering the China market to sell to China. Some 94 percent of American respondents to a U.S.-China Business Council survey said they were now in China to sell products, not for cheap export manufacturing. Similar patterns are occurring elsewhere in Asia as that particular article indicates.

“We have long seen that Asia is the key to sustained growth and development and have adjusted our practice accordingly,” comments Chris Devonshire-Ellis, principal and founding partner of Dezan Shira & Associates. “It is important for businesses throughout China, the United States, the EU, and elsewhere to be able to recognize what is going on in Asia and to adapt to these tremendous new opportunities. Growth is out there and it now requires a full appreciation of Asia, rather than limited knowledge of just one country, in order to maximize the potential the region has to offer.”

Dezan Shira & Associates provides foreign investment legal, tax, accounting and business advisory services to international companies throughout Asia. The practice celebrated its 20th anniversary earlier this year and now has 17 offices across Asia, including locations in China, Hong Kong, Singapore, India and Vietnam. The firm will launch the “ASEAN Briefing” website in January next year. To contact the practice, please email asia@dezshira.com or visit the firm’s website at www.dezshira.com.

Related Reading

Why ASEAN Matters for Your China Business

Hedging China – Manufacturing and Selling in India, Vietnam and Myanmar

ChinaGlare – Has Your China Business Become Too China-Centric?

- Previous Article China Eases FDI Rules Concerning the Administration of Foreign Exchange

- Next Article New Issue of China Briefing: The Asia Tax Comparator