Effect of China’s New Social Insurance Law on Foreign Employees/Employers

Jul. 26 – China’s new Social Insurance Law (SIL) – which just took effect on July 1 – has attracted more attention than ever from foreigners living in China because of the provision set out in Article 97 which has been frequently translated into English in the following manner:

“Expatriates working in China may participate in social insurance schemes in accordance with this law.”

While China has already issued a document specifically clarifying foreign employees’ participation in the country’s social welfare system, it still has not made it 100 percent clear specifically which types of foreign individuals will be included in the scheme, and precisely how the new law will impact their paychecks and welfare. In his recent presentation, Adam Livermore, regional manager at Dezan Shira & Associates, introduced China’s social welfare system in detail at an event held by Servcorp in Beijing and cast a light on the new law’s potential effect on foreign employees.

Introduction of China’s social welfare system

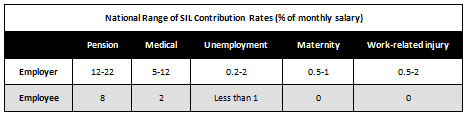

China’s social insurance system is comprised of pension, medical insurance, unemployment insurance, maternity insurance and work-related injury insurance. The table below offers a general range of SIL contribution rates across the country and should help foreigners (and their employers) in China figure out how much more they may need to pay once they are involved in the country’s social welfare system. It is important to note that foreigners in every city should learn the actual contribution rates applicable in their area, since the rates can vary considerably by region.

However, for a foreign individual who earns a salary three times higher than the average social salary in his/her city, the amount the individual and the individual’s employer needs to contribute is:

- Employer/employee contribution rates to mandatory benefit = three times the city’s average monthly social salary × the applicable contribution rates

For example, the social average monthly salary for Beijing is currently RMB4,201, so the maximum amount of salary that employers/employees will have to account for in terms of social welfare contributions is RMB12,604. Please note that this figure will also vary across regions.

The clarification and confusion arising from “The Interim Measures for the Participation in Social Insurance of Foreigners Employed in China”

Having realized that the administration of foreign employees within China’s social welfare system may be more complex than for Chinese citizens, the central government issued a document entitled “The Interim Measures for the Participation in Social Insurance of Foreigners Employed in China (Draft for Comments)” on June 10 in an attempt to clarify issues related to the pension refund as well as the compliance to international social insurance treaties. It explicitly states that:

- Expatriates are required to participate in the Chinese social insurance system and pay the social insurance premiums in accordance with relevant regulations

- Where a foreigner departs China prior to the stipulated age for receiving pension, his/her individual account will be retained. If the foreigner reenters China for employment, the contribution period can be calculated cumulatively

- Upon written application by the foreigner, the social insurance agency may pay the foreigner the amount in his/her individual account in one lump sum and terminate the basic pension relationship

- Upon the foreigner’s death, the amount remaining in the individual pension insurance account can be inherited

- For foreigners who are nationals of countries that have entered bilateral or multilateral treaties relating to social insurance with China, his or her social insurance participation will be handled in accordance with such treaties

However, in his presentation, Livermore pointed out there is still confusion regarding the new document that may need further legal explanation from the government.

First of all, it is not clear who exactly will be included in the program. Livermore believes foreigners employed by Chinese entities (including representative offices) holding work permits will most likely be included, and foreigners employed by overseas entities but staying over 183 days in China during a year may also be required to participate in the scheme. Citizens of countries with bilateral agreements in place (currently Germany and South Korea) may be partially exempted if they can prove they are making contributions in their home country.

Secondly, it remains unknown when foreigners’ participation in the scheme will actually be implemented and whether implementation in different cities will vary. Since the new SIL already became effective on July 1, there is a possibility that foreigners’ contributions may be backdated at a later date to July 2011. However, some experts speculate that actual implementation will likely commence from 2012, as backdated contributions may add complications to effective administration of the system.

Thirdly, experts are still wondering whether foreigners will need to contribute to all the five social insurance items. According to Livermore’ presentation, it is likely that foreigners will at least be subject to pension and medical insurance contributions, the two most important components of China’s social insurance system.

Based on such speculation, questions arise concerning how exactly foreigners can claim their pension contribution back when they plan to leave China and whether they can actually benefit from their contributions. For example, no regulations so far have clarified the precise procedures to redeem pension as a lump-sum or the proportion of pension foreigners will finally obtain. In addition, if a foreigner has worked in China for 15 years and is eligible to claim his/her own pension, there is no clear guidance yet that shows the individual how to collect it.

Since the quality of medical services covered by medical insurance is one of the major concerns of most foreigners living in China, it is also essential that future regulations clarify whether foreigners’ contributions to medical insurance will at least partly cover the cost incurred from using international clinics.

While foreigners may also be forced to contribute to work-related injury insurance, maternity insurance and unemployment insurance, further explanations may be needed from the government to justify the contributions. For example, will practices of maternity insurance be consistent between Chinese nationals and foreigners under the current regulations that do not restrict foreigners to the one-child policy? How do foreigners out of employment benefit from unemployment insurance when they are not legally allowed to stay in the country if not employed?

The “Interim Measures” document is only a draft so far and it remains unclear whether or how the Chinese authorities will adjust the implementation details based on different social voices. However, from the perspective of foreign employees, it is critical that the new regulations be made fair and transparent enough to allow them to benefit from the welfare system in proportion to their contributions.

The bright side

While many foreign employees in China may worry about losing more money out of their paychecks to the social welfare system, they may also want to look on the bright side.

First of all, if the pension contributions – the largest portion of the individual contribution – can be redeemed tax-free, foreigners may effectively end up paying slightly less individual income tax.

Secondly, more bilateral treaties may be put in place once all the related regulations are officially released, and that will allow citizens of more countries to enjoy conditional exemptions from the social mandatory system.

Third, compared to other countries, caps on contributions in China are still relatively low.

It is also hoped that, in the long term, foreigner participation in the Chinese social welfare system will drive the various state insurance systems – particularly the medical insurance system – to function more effectively, so an increasingly robust and transparent system will offer more benefits to both Chinese nationals and foreigners.

Dezan Shira & Associates is a boutique professional services firm providing foreign direct investment business advisory, tax, accounting, payroll and due diligence services for multinational clients in China, Hong Kong, Vietnam and India. For further information and clarification on China’s new Social Insurance Law, please email info@dezshira.com or visit the firm at www.dezshira.com.

Related Reading

China Expats, Employers to Get Hit With Social Welfare Costs

Beijing Announces Wage Bases for 2011 Social Security Payments

New Social Insurance Law Aims to Improve Social Welfare System in China

China Adopts Social Insurance Law, Workers Given Right to Transfer Pension

The RMB Position and the Mysteries of the China Unemployment Fund

- Previous Article SAT Clarifies CIT Calculation Issues Regarding Expenses, Fixed Asset Values

- Next Article SAT Specifies Time When VAT Obligations Take Place