The China Alternative – Nepal

The China Alternative is our series on other manufacturing destinations in emerging Asia that may soon be starting to compete with China in terms of labor costs, infrastructure and operational capacity. In this issue we look at Nepal.

The China Alternative is our series on other manufacturing destinations in emerging Asia that may soon be starting to compete with China in terms of labor costs, infrastructure and operational capacity. In this issue we look at Nepal.

By Lena Xia

Jun. 24 – On May 28, 2008 a new flag was unveiled above the main palace in Katmandu, a day after Nepalese lawmakers voted to abolish the monarchy that had ruled the country for the past 239 years. While the recently established republic marks a giant step forward politically for a country that had been swamped in civil war for a decade, Nepal’s economy has yet just been brought back to the right track.

Economic overview

The CIA World Factbook evaluates Nepal as one of the poorest and least developed countries in the world, with almost one-quarter of its population living below the poverty line. Nepal is an agricultural economy: three-fourths of the population earns a livelihood from agricultural activities and one-third of GDP is generated from that particular industry.

Nepal has a huge potential for hydropower that comes to about 83,000 megawatts out of which 43,000 megawatts is economically viable, but political instability has knifed the country’s foreign investment and modernization efforts. On top of that, challenges such as a landlocked geographic location, susceptibility to natural disasters, and civil strife all hamper the country’s economic growth.

With an area of 147,181 square kilometers and a population of approximately 30 million, Nepal is the world’s 93rd largest country by land mass and the 41st most populous country. Nepal lies in between India and China and manages to maintain good economic rapport with both of its neighbors, but especially with China. Other close neighbors of Nepal are Bangladesh, Bhutan and Pakistan.

Nepal along with Bangladesh, Bhutan, India, the Maldives, Pakistan and Sri Lanka make up the seven member countries of the South Asian Association for Regional Cooperation (SAARC). The SAARC nations have a Preferential Trading Arrangement and are heading towards a free trade area under the SAARC framework.

For foreign investors, it is worth noting that Nepal’s economy is continuously progressing and that the government is attempting to attract more foreign capital. During the recent Global Financial Crisis, remittances from foreign workers abroad increased 47 percent to US$2.8 billion while tourist arrivals only decreased 1 percent compared to the previous year. Up to 2010, Nepal had a GDP of US$35.81 billion, ranking it the 102nd in the world, and according to the Economist Intelligence Unit, real GDP will grow at an average annual rate of 4.5 percent in fiscal years 2010/11-2011/12 (July 16 – July 15).

Global business rankings

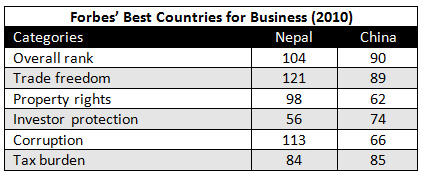

In its “Best Countries for Business” index, Forbes ranked Nepal a lowly 104th out of 128 in 2010, which is a slight improvement from its rank of 110th in 2009. When compared to the economic giant, China, Nepal is doing relatively better in terms of investor protection (55th vs. 74th) and tax burden (84th vs. 85th).

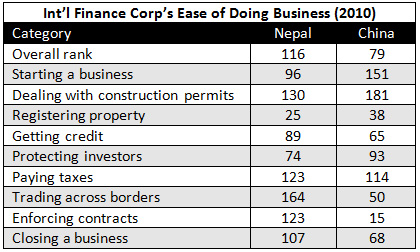

In its “Ease of Doing Business” index – another leading global business ranking system –International Finance Corporation ranked Nepal 116th out of 183 nations in 2010. Although Nepal’s overall ranking still has lots of room to improve, the country is doing very well regarding registering property and above average in protecting investors. As the country’s peace process evolves and economic stability returns, the government has been putting a great deal of effort into making Nepal a more attractive destination for foreign direct investment. Notice that Nepal has a significantly better ranking than China in terms of starting a business while also maintaining an edge in protecting investors and registering property, which is very encouraging and inspiring for those who are looking at the country as a possible China alternative.

Foreign investment

The biggest concern when investing in Nepal has always been the political instability as well as nationalization. To assure the security of investments, the Law of Nepal protects foreign capital against nationalization. Meanwhile, Nepal being a member of the Multilateral Investment Guarantee Agency assures foreign investors against non-commercial risks like currency transfer, breach of contract, war and civil disturbances in the country.

Furthermore, after peace was restored in the country, Nepal has introduced several programs to promote foreign investment, including both tax and non-tax incentives.

Some incentives and facilities accorded by the government to foreign investors are:

- No income tax on dividends, export earnings, and interest earned on foreign loans

- An additional 10 percent rebate on income tax to any industry providing direct employment to 600 or more Nepalese citizens

- Examples of reimbursements are:

- Customs duty and sales tax on raw materials meant for industrial use

- Sales tax and excise duty levied on products sold to Export Promotion House

- The customs duty, sales tax, excise duty and premium levied on raw materials, etc. used for production by an export industry.

- Examples of deductions are:

- 40 percent of the value of new additional fixed assets from taxable income to industries that diversify production through reinvestments or expanding installed capacity by 25 percent or more

- Up to 50 percent from the taxable income for the investment made on process or equipment for non-pollution

- 10 percent from gross profit that goes for technology or product development and skill enhancement

- In addition, a foreign investor can employ expert or technical personnel in the foreign investment project from his/her particular country upon the permission of the Labor Department and these experts can remit up to 75 percent of their income in convertible currency.

According to Nepal’s Department of Industry, foreign direct investment projects tend to favor the following sectors:

- Agriculture and forestry

- Manufacturing

- Energy

- Construction

China, the United States, India, the United Kingdom, Norway, Japan, South Korea and Germany are the leading countries with highest number of projects in Nepal. Generally, almost every sector in Nepal is open and welcome to investment, including manufacturing, energy, and mining, but the following sectors that are restricted:

- Cottage, arm and ammunition industries

- Explosives and atomic energy

- Real estate

- Poultry and fisheries

- Some other sensitive industries directly relating to public health, environment and defense

Given the perennial nature of Nepali rivers and the steep gradient of the country’s topography, Nepal has ideal conditions for the development of some of the world’s largest hydroelectric projects. However, Nepal has not been able to exploit much of this potential and the people in the country continue to face severe power shortages. In fact, Nepal has developed only approximately 600 megawatts of hydropower while it is estimated that the nation has approximately 40,000 megawatts of economically feasible hydropower potential.

Other natural resources such as stone and limestone, talc, silica, dolomite and natural gas all need to be further explored. According to the Ministry of Industry, only about 30 percent to 35 percent of the total demand of cement is fulfilled by internal production, leaving ample opportunities to exploit existing cement grade limestone and establish more allied industries in Nepal.

Furthermore, when competing with other developing countries for foreign investment, Nepal has a comparatively low labor cost. The country’s labor pool is huge, with plenty semiskilled and skilled workers, as well as unskilled laborers who generally work 8 hours a day and 48 hours a week. On top of that, Nepal produces around 10,000 qualified engineers and other IT graduates annually, and due to the lack of opportunities in Nepal, most candidates make their way overseas to the United States, United Kingdom, and Australia. These candidates can be tapped by the early investors.

For now, Nepal’s business environment is still relatively immature, as the government itself is still seeking better ways to reintegrate the nation. But because of the underdevelopment, Nepal is a virgin land for foreign investment, not unlike China some 25 years ago, making for a potentially lucrative market. Other advantages that Nepal has when compared with its neighbors are lower interest rates and easy capital. Corporate loans are available at annual interest rates of 4 percent to 5 percent, while it costs more than 10 percent India. However, foreign investors are encouraged to take cautious steps when investing in Nepal since a degree of political uncertainty still exists. Generally, all the problems in Nepal come down to politics.

Related Reading

The China Alternative

The China Alternative

Our complete series on other manufacturing destinations in Asia that are now starting to compete with China in terms of labor costs, infrastructure and operational capacity.

China’s Neighbors

China’s Neighbors

This unique book is an introductory study of all 14 of China’s neighbor countries: Afghanistan, Bhutan, India, Kazakhstan, Kyrgyzstan, Laos, Myanmar, Mongolia, Nepal, North Korea, Pakistan, Russia, Tajikistan and Vietnam.

Operational Costs of Business in China’s Inland Cities

Operational Costs of Business in China’s Inland Cities

It is widely held that land and labor costs in inland provinces offer quite significant cost savings over major east coast and southern cities. In this issue, we take a quick look at the numbers behind these beliefs.

- Previous Article U.S. Multinationals Reconsider China-Based Manufacturing

- Next Article Chinese Investment in the West: Drop the Labor, then Do the Math