An Overview of China’s Renewable Energy Market

Jun. 16 – China’s renewable energy development, financially immense, is part of the state government’s long-term domestic diversification and self-sufficiency strategy. The country’s renewable energy market grew by 15.5 percent year-on-year in 2010 to US$20.5 billion.

Jun. 16 – China’s renewable energy development, financially immense, is part of the state government’s long-term domestic diversification and self-sufficiency strategy. The country’s renewable energy market grew by 15.5 percent year-on-year in 2010 to US$20.5 billion.

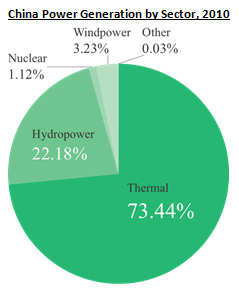

In the 12th Five-Year Plan, policymakers called for non-fossil fuel energy production to reach and stay above 11 percent of total energy production by 2015. The wide range of alternative power generation systems encompassed under the heading “non fossil fuel energy” include the energy sources of hydropower, wind power, solar power, biogas, and nuclear. The first four are discussed in this article.

While China’s renewable energy development is largely driven by a monstrous demand for energy juxtaposed by a limited supply of traditional energy resources, it is also driven by pressure to reduce environmentally-harmful emissions. These include sulfur dioxide, nitrous dioxide, methane, and most prominently carbon dioxide. The 12th Five-Year Plan explicitly aims for a 17 percent reduction in carbon dioxide emissions by 2015. Specific reduction goals indicated by China’s National Development and Reform Commission vary geographically, as shown in the map below.

China will spend an estimated US$1.54 trillion on clean energy projects in the next 15 years. Government investments in this sector come through a variety of channels, including state-owned investment vehicles and financial institutions and financial and tax policies. China Investment Corporation, a US$300 billion-asset-holding state wealth fund, is investing heavily in Chinese clean-energy companies and foreign operators with projects in China. Similarly, the China Energy Conservation Investment Corporation, a state holding company, invests heavily in energy conservation, pollution control and renewable energy private sector projects.

For foreign companies in particular, mergers and acquisitions in the green energy sector are also hot, especially between Chinese and foreign companies as the former look to capitalize on foreign technology and expertise and the latter on bigger roles in China. Worldwide M&A deals in renewable energy grew 225 percent year-on-year in 2010, with solar and wind power responsible for around one-third of the deals in both industries. M&A deals in the green energy sector in China amounted to US$2.126 billion in 2010 – 60 percent of renewable energy sector deals in the Asia Pacific.

Below is a quick overview of China’s four main renewable energies: solar, wind, hydropower, and biogas.

Solar power

Solar energy reportedly accounts for less than 0.01 percent of domestic energy production in China, but this speaks more to the large size of the country’s energy sector than anything else. China is in fact the major player in the international solar power market, both in terms of absolute production and consumption. In fact, the country manufactured the most solar panels in the world in 2010. In terms of consumption, it boasted 65 percent of the world’s solar water heaters, including 80 percent of newly installed water heaters in 2010.

And the sector is still growing – solar energy is the government’s “poster child” of renewable energy growth. This includes domestic consumption, which is receiving a strong government push. Last month, China updated its target to 10 gigawatts for installed solar power capacity by 2015 and 50 gigawatts by 2020, according to an official at the National Development and Reform Commission’s Energy Research Institute.

Among the government tax incentives specifically targeted at the solar sector, the government provides subsidies on investments under what is referred to as the Golden Sun Program, announced by the National Development Reform Commission in July 2009. These subsidies include 50 percent of grid-connected solar investments and 70 percent of off-grid photovoltaic power investments (300 kilowatt minimum capacity, 1-year maximum construction period, 20+ years planned operations).

Wind power

In 2010, every second newly-installed wind turbine internationally was installed in China. In the words of Secretary General of the Global Wind Energy Council Steve Sawyer, “China has become the single largest driver for global wind power development.”

From 2004 to 2009, the compound annual growth rate of the wind energy sector in China was 134 percent, accounting for an added 13.8 gigawatts of energy. China is the largest wind energy producer in the world, with a total installed wind power capacity of 44.5 gigawatts.

Foreign players entering the wind power market will likely best be able to participate in projects organized on a provincial level, the Boston Consulting Group (BCG) suggests in a recent study analyzing market share in provincial, national, and offshore projects. So far, international players have been barred from participation in projects on a national level, and the forecast for 2015 assumes this policy stance. Though the proportion of national level projects to provincial level projects is set to increase significantly from 2009 to 2015, the total number of provincial level opportunities for foreign players is likely to increase based on what we know to be China’s increase in overall renewable energy efforts.

The largest turbine manufacturer in China will likely be generating more than US$3 billion in annual revenue at 10 percent to 15 percent profit margins according to the same BCG report, a stunning achievement compared to an estimated US$200 million to US$300 million in annual revenues in 2007.

Among the government tax incentives specifically targeted at this sector is an immediate VAT rebate (50 percent) applied to selling self-manufactured electric power generated from wind power.

Additionally, the NDRC enacted a fixed feed-in tariff for electricity produced by new onshore wind power in 2009. The tariffs per kilowatt hour are set at RMB0.51, RMB0.54, RMB0.58, and RMB0.61 and represent a significant premium on the average rate of RMB0.34 per kilowatt hour paid to coal-fired electricity generators.

Overall regulations in the sector have been quite restrictive for direct foreign involvement, and with heavy competition from Chinese wind power companies, many foreign players have been getting involved in the sector through M&As and JVs.

Hydropower

China leads the world in total installed hydropower capacity with 213 gigawatts at the end of 2010, primarily located in the western and southern provinces. Having plateaued for a bit in the 1990s, hydropower development has gained renewed government support over the last decade, benchmarked in 2006 by the completion of the initial phase of the Three Gorges Dam on the Yangtze River. Full completion of the Three Gorges Dam is expected early this summer, with the last turbine currently in testing.

While the Three Gorges Dam has received the lion’s share of international attention, other hydropower stations are almost equally massive. The Xiluodu and Xiangjiaba hydropower stations on the Jinsha River, for example, have a combined capacity of 18.6 gigawatts – greater than that of the Three Gorges Dam. Yet the social and environmental issues connected to large-scale hydropower – such as population relocation, ecological disruption, and arable land disruption – have caused state agencies to increase their support for smaller, rural hydropower facilities with 50,000 kilowatt capacity or less. Rural hydropower capacity is expected to reach 74 gigawatts by 2015, according to China’s Water Resources Ministry, roughly 26 percent of total hydropower capacity by that year. Between the second half of 2010 and the first quarter of 2011, 10 new major hydropower stations were approved, with 50 gigawatts of total installed capacity and investments of more than RMB200 billion.

China’s installed hydropower capacity is estimated to reach 380 gigawatts by 2020, according to a 2011 analysis completed by China Research & Intelligence. Hydropower equipment production, construction material and operational support services, technology improvement, and transmissions technologies are just some of the areas foreign investors may be able to contribute to.

Biogas

Biogas – a renewable natural gas substitute from the anaerobic digestion of solid waste – is gaining ground in China as a renewable energy source.

As China is the world’s second-largest consumer of corn and the producer of half the world’s pork, the country will soon be in critical need of wide-spread installations of biogas digesters. In 2010, the national pollution survey estimated that 406 million tons of animal waste was dumped into waterways in 2007. State government now mandates biogas digesters for farms with over 1,000 cattle, 10,000 pigs, or 100,000 chickens, but while there are multiple state, provincial and local subsidies available, only about 3 percent of China’s large and medium-sized operations currently have proper facilities to handle waste.

On the usage side of biogas production, daily cooking and single-home lighting were once the only feasible uses for the small amounts of fuel that came from rudimentary small-scale digesters in China. But with modern technology and expanded capacity potential, current biogas engines manufactured by the likes of GE are capable of churning natural waste into large amounts of renewable energy. In Nanyang, Henan Province, for instance, a 36-megawatt power station running GE engines is being installed in one of the nation’s largest ethanol plants to produce electricity for use on the regional grid within the plant itself. The station is expected to reduce annual carbon emissions by 1.1 million tons. Certain biogas processes are also capable of producing energy for chemical production and vehicle fuel.

Portions of this article were taken from the June 2011 issue of China Briefing magazine titled, “Foreign Investment in China’s Green Sector.” This issue is essential reading for anyone looking at China’s green tech market. To purchase the full version, priced at US$10 for immediate PDF download, please access the Asia Briefing Bookstore here.

Portions of this article were taken from the June 2011 issue of China Briefing magazine titled, “Foreign Investment in China’s Green Sector.” This issue is essential reading for anyone looking at China’s green tech market. To purchase the full version, priced at US$10 for immediate PDF download, please access the Asia Briefing Bookstore here.

Dezan Shira & Associates is a boutique professional services firm providing foreign direct investment business advisory, tax, accounting, payroll and due diligence services for multinational clients in China. The firm assists foreign enterprises take advantage of special tax incentives in the country. For advice, please email tax@dezshira.com, visit www.dezshira.com, or download the firm’s brochure here.

Related Reading

Doing Business in China

Doing Business in China

Our 156-page definitive guide to the fastest growing economy in the world, providing a thorough and in-depth analysis of China, its history, key demographics and overviews of the major cities, provinces and autonomous regions highlighting business opportunities and infrastructure in place in each region. A comprehensive guide to investing in China is also included with information on FDI trends, business establishment procedures, economic zone information, and labor and tax considerations.

The China Tax Guide (Fifth Edition)

The China Tax Guide (Fifth Edition)

This popular book, fully updated with all recent tax changes and amendments, details all taxes in China affecting businesses and individuals, how to calculate the amounts due, tax registration and filing procedures, tax minimization techniques, and claiming VAT rebates. It also details good financial management techniques, handling negotiations with the tax bureau and annual audit and compliance procedures.

Selected Tax Incentives in China’s Renewable Energy Sector

- Previous Article Selected Tax Incentives in China’s Renewable Energy Sector

- Next Article China Drafts New Details to Vehicle and Vessel Tax Law